Why electric beats hydrogen in the race to decarbonise freight vehicles in Australia

Transport is Australia's third-largest[1] and fastest-growing[2] source of emissions, accounting for 23% of the total. Without intervention, transport is expected[3] to be the leading source of emissions by 2030. Transport emissions increased by 3.6%[4] from 2022 to 2023.

Emissions from on-road diesel, which dominates the freight sector, were up by 3.7%. Diesel vehicle numbers (passenger, light commercial, freight and buses) in Australia have grown by 84%[5] since 2014, compared to 5% for petrol vehicles. Passenger cars account for 44% of all transport emissions[6] and freight trucks 23%.

One of the quickest ways to cut these emissions[7] is to electrify vehicles[8]. It's relatively easy[9] to do for cars. Trucks are a harder[10] challenge[11].

To find out how best to decarbonise trucks in Australia, our research[12] evaluated the lifecycle emissions[13] from low-emission[14] trucks. We focused on electric[15] and hydrogen[16] trucks. We also compared their performance to diesel trucks across[17] five types of rigid[18] and three types of articulated[19] trucks.

Our results[20] show electric trucks are the better, faster option to decarbonise road freight by the legislated[21] target dates for emission cuts. In some cases, hydrogen trucks had two to three times the emissions intensity[22] (the amount of greenhouse gases emitted per kilometre travelled) of electric trucks.

Why is a lifecycle analysis needed?

In the race to rapidly decarbonise road freight, it's important to identify the most efficient and cost-effective technology. Electric and hydrogen trucks both have zero tailpipe emissions.

However, we must consider their full lifecycle to assess overall carbon footprints. The production, use and recycling phases of the two kinds of trucks produce different emissions. Electric trucks[23] use batteries that are charged directly from a power source.

The cleaner the electricity source, the lower the emissions. Hydrogen trucks[24] also have batteries[25], though smaller than in electric trucks, but rely mainly on fuel cells powered by hydrogen to produce electricity that drives the wheels. Currently, around 96%[26] of the world's hydrogen comes from coal or natural gas[27].

This results in large emissions. Hydrogen can be produced using renewables to power a process of electrolysis[28] that extracts it from water. But this involves many steps[29], each with energy penalties and losses.

Hydrogen storage tanks and delivery equipment are also needed. These are complex, costly[30] and energy is lost[31] at each step in the supply chain. On average, only 38%[32] of the source energy remains to drive the wheels of a hydrogen truck, compared to around 80%[33] for battery electric trucks.

What did the study look at?

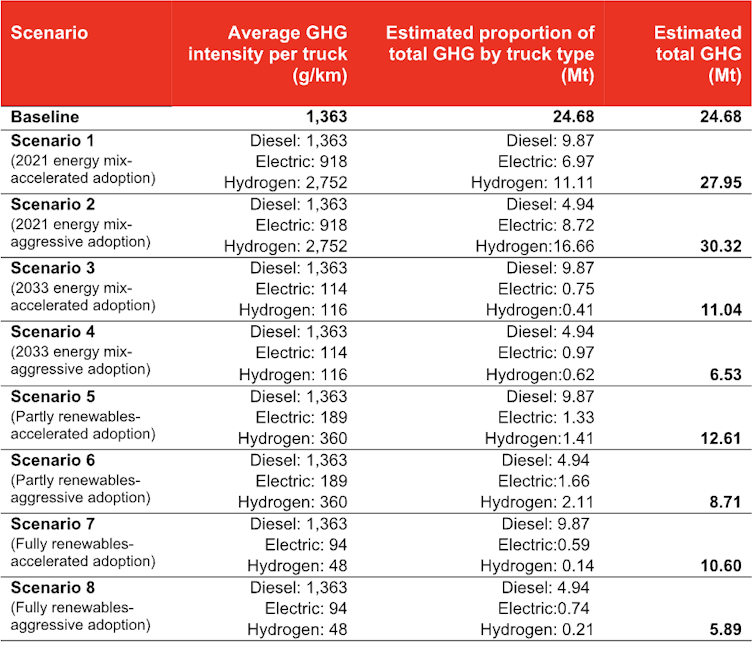

We analysed lifecycle emissions for freight trucks in eight different scenarios of renewable energy mixes and adoption rates.

First, the lifecycle analysis[34] considers emissions from fuel and electricity production using primary energy sources (fossil fuels and renewables). It also takes into account emissions from making trucks. This phase includes extracting raw materials, processing, production and truck assembly.

In the operations phase, we consider emissions from driving, maintenance and servicing. Finally, our analysis evaluates end-of-life emissions from repurposing components, recycling materials and disposal.

Lifecycle analysis of the carbon footprint of vehicle technologies.What did we find?

We applied the widely used GREET[35] lifecycle analysis model, adapted[36] to Australian conditions. We first modelled a baseline scenario.

It reflected Australia's 2019 energy mix, truck fleet composition and validated travel distances for each truck type. We then modelled eight scenarios with different energy mixes of fossil fuels and renewables. (Click here[37] for full details.) The scenarios also included different mixes of diesel, electric and hydrogen trucks.

We modelled truck adoption rates[38] and the impacts on emissions. As expected, scenarios[39] that combined high rates of renewable energy and adoption would lead to lower emissions than other scenarios. Under a fully renewable scenario with 50% electric and 30% hydrogen trucks, freight emissions would fall by 76%, from 24.68 million tonnes (Mt) to 5.89 Mt.

In all scenarios with fossil fuels in the energy mix, hydrogen trucks had a higher lifecycle emissions intensity than electric trucks. In some cases, hydrogen trucks produced roughly three times the emissions of electric trucks.

Emissions intensity and lifecycle emissions from the three types of freight truck in the eight scenarios. Authors, Swinburne University of Technology

Emissions intensity and lifecycle emissions from the three types of freight truck in the eight scenarios. Authors, Swinburne University of Technology

Our findings highlight the challenge of cutting emissions from manufacturing, maintenance and disposal. On average, they account for 90 grams per kilometre for electric trucks and 40g/km for hydrogen trucks.

If we don't cut these emissions, they end up accounting for a big share of lifecycle emissions. For example, in the 2033 energy mix scenario they would account for 79% of emissions for electric trucks and 39% for hydrogen trucks. Emissions from making and disposing of batteries will likely fall as their design[40] evolves to aid recycling[41].

Batteries can be redesigned to make them much easier to recycle.Is the industry ready for the transition?

We also conducted an online survey[42] involving 40 small, 60 medium and 30 large trucking organisations.

Around 47% of participants rated their knowledge of electric and hydrogen trucks as basic, 42% as intermediate and 11% as advanced. About 62% of operators said they had a formal decarbonisation strategy. Those with larger fleet sizes and/or involved in long-haul trucking were more committed to decarbonisation.

Only seven out of 130 participants were ready to absorb the higher purchase cost of low-emissions trucks. Most thought customers would not be willing to pay more for green freight services. They viewed high upfront purchase costs, total ownership costs and a lack of supporting infrastructure as barriers to adoption.

The road ahead

To overcome these barriers and speed up the shift to low-emissions trucks, a mix of industry[43] interventions and policies[44] is needed.

Global investment[45] in truck manufacturing will make more suitable models and a variety of sizes available[46] and more affordable[47]. Tighter emission standards[48], government and industry investment in infrastructure[49] such as ultra-rapid charging stations[50] and incentives[51] such as subsidies will also help. Another barrier is uncertainty about performance and costs.

Independent trials[52], field testing and knowledge sharing[53] will reduce this uncertainty and help operators and policymakers with their decisions. Finally, our findings show fleet decarbonisation on its own is not an entirely effective strategy to cut emissions. It needs to be part of a holistic approach to cut emissions across the transport sector[54].

This includes managing demand[55] through measures such as heavy vehicle pricing[56] and taxation, shifting road freight to rail[57] and optimising[58] how we distribute freight.

Without these measures, Australia's dependence on fossil fuels will deepen.

Reaching our emission targets will become even harder.

References

- ^ third-largest (www.dcceew.gov.au)

- ^ fastest-growing (www.dcceew.gov.au)

- ^ expected (www.dcceew.gov.au)

- ^ increased by 3.6% (www.dcceew.gov.au)

- ^ grown by 84% (www.dcceew.gov.au)

- ^ transport emissions (www.dcceew.gov.au)

- ^ cut these emissions (theconversation.com)

- ^ electrify vehicles (www.greenvehicleguide.gov.au)

- ^ relatively easy (www.dcceew.gov.au)

- ^ harder (www.transportenvironment.org)

- ^ challenge (www.nature.com)

- ^ research (imoveaustralia.com)

- ^ lifecycle emissions (vimeo.com)

- ^ low-emission (www.volvotrucks.com)

- ^ electric (www.youtube.com)

- ^ hydrogen (www.scania.com)

- ^ across (www.nti.com.au)

- ^ rigid (www.nhvr.gov.au)

- ^ articulated (www.nhvr.gov.au)

- ^ Our results (imoveaustralia.com)

- ^ legislated (www.aph.gov.au)

- ^ emissions intensity (www.climatechangeauthority.gov.au)

- ^ Electric trucks (x.com)

- ^ Hydrogen trucks (www.scania.com)

- ^ batteries (einride.tech)

- ^ around 96% (www.theguardian.com)

- ^ coal or natural gas (climate.mit.edu)

- ^ electrolysis (www.theguardian.com)

- ^ many steps (theconversation.com)

- ^ complex, costly (einride.tech)

- ^ energy is lost (theconversation.com)

- ^ only 38% (theconversation.com)

- ^ around 80% (theconversation.com)

- ^ lifecycle analysis (www.transportationenergy.org)

- ^ GREET (www.energy.gov)

- ^ adapted (imoveaustralia.com)

- ^ here (cdn.theconversation.com)

- ^ truck adoption rates (cdn.theconversation.com)

- ^ scenarios (cdn.theconversation.com)

- ^ their design (norwegianscitechnews.com)

- ^ recycling (www.nature.com)

- ^ survey (imoveaustralia.com)

- ^ industry (www.euronews.com)

- ^ policies (www3.weforum.org)

- ^ investment (theicct.org)

- ^ available (theicct.org)

- ^ more affordable (einride.tech)

- ^ standards (www.infrastructure.gov.au)

- ^ infrastructure (minister.dcceew.gov.au)

- ^ ultra-rapid charging stations (evse.com.au)

- ^ incentives (www.australiantruckradio.com.au)

- ^ trials (www.zemo.org.uk)

- ^ knowledge sharing (theicct.org)

- ^ across the transport sector (theconversation.com)

- ^ managing demand (www.freightaustralia.gov.au)

- ^ heavy vehicle pricing (www.transparency.gov.au)

- ^ rail (www.abc.net.au)

- ^ optimising (www.csrf.ac.uk)