Government Copper Stockpiles Put Freeport McMoRan Valuation And Role In Focus

Find winning stocks[1] in any market cycle. Join 7 million investors using Simply Wall St's investing ideas for FREE.

-

US Project Vault and parallel Chinese efforts are expanding government-backed copper stockpiles.

-

These programs are increasing attention on long term copper supply security and logistics.

-

As a major producer, Freeport-McMoRan (NYSE:FCX) sits at the center of discussions about government driven copper demand.

For you as an investor, the growing US and Chinese copper stockpiling programs highlight how central Freeport-McMoRan is to the physical copper market. The company focuses on copper mining and production, which ties its business directly to long term themes such as electrification, grid upgrades, and energy transition projects that rely heavily on copper as a core input.

These new reserve building efforts are not a short term trading story; they reflect how governments view copper as a critical resource.

As policies evolve and stockpiling plans mature, NYSE:FCX may continue to serve as an important reference point whenever the conversation turns to copper availability, security of supply, and which producers can reliably deliver metal into the system.

Stay updated on the most important news stories for Freeport-McMoRan[2] by adding it to your watchlist[3] or portfolio[4]. Alternatively, explore our Community[5] to discover new perspectives on Freeport-McMoRan.

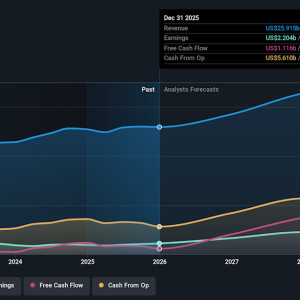

NYSE:FCX Earnings & Revenue Growth as at Feb 2026

NYSE:FCX Earnings & Revenue Growth as at Feb 2026

How Freeport-McMoRan stacks up against its biggest competitors[6]

-

? Price vs Analyst Target: At US£63.26, FCX trades about 2.9% above the US£61.47 analyst target, which is close to consensus.

-

?

Simply Wall St Valuation: FCX is flagged as trading 25.9% below Simply Wall St's estimated fair value.

-

? Recent Momentum: The stock has returned roughly 11.9% over the past 30 days.

Check out Simply Wall St's in depth valuation analysis for Freeport-McMoRan[7].

-

? Government copper stockpiling highlights FCX's role as a key supplier when policy makers focus on long term supply security.

-

?

Watch how FCX's P/E of 41.2 compares to the 27.3 industry average, and monitor how any contracts or commentary link to these stockpile programs.

-

? One flagged risk is significant insider selling over the past 3 months, which some investors may weigh alongside the government demand story.

For the full picture including more risks and rewards, check out the complete Freeport-McMoRan analysis[8].

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

References

- ^ Find winning stocks (simplywall.st)

- ^ Freeport-McMoRan (www.simplywall.st)

- ^ watchlist (simplywall.st)

- ^ portfolio (simplywall.st)

- ^ Community (simplywall.st)

- ^ How Freeport-McMoRan stacks up against its biggest competitors (www.simplywall.st)

- ^ in depth valuation analysis for Freeport-McMoRan (finance.yahoo.com)

- ^ complete Freeport-McMoRan analysis (finance.yahoo.com)