Road Haulage Market | Global Market Analysis Report

Road Haulage Market Size and Share Forecast Outlook 2025 to 2035

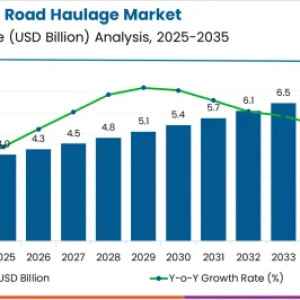

The road haulage market is estimated to be valued at USD 4.0 billion in 2025 and is projected to reach USD 7.3 billion by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period. The road haulage market, estimated at USD 4.0 billion in 2025 and projected to reach USD 7.3 billion by 2035 at a CAGR of 6.0%, exhibits pronounced regional growth imbalances shaped by industrial expansion, logistics demand, and regulatory environments. Asia-Pacific is expected to dominate market growth, driven by rapid expansion of manufacturing and e-commerce sectors, increasing intra- and inter-country freight volumes, and the ongoing development of transport infrastructure.

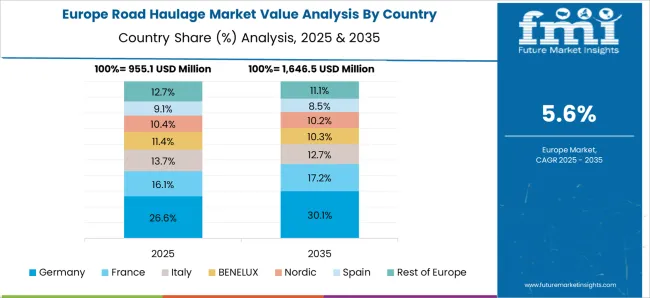

Investment in highway networks and freight corridors enhances operational efficiency, positioning the region for faster adoption of advanced haulage technologies and fleet optimization solutions. Europe's growth is comparatively moderate due to mature logistics networks, stricter environmental regulations, and saturated freight capacity. The region focuses on operational optimization, fleet electrification, and compliance-driven investments rather than large-scale expansion.

North America occupies an intermediate position, where stable economic activity and modernization of aging infrastructure support steady market growth. The regulatory constraints, labor availability, and rising fuel costs temper expansion, keeping CAGR lower than in Asia-Pacific. The imbalance highlights a divergence between high-growth emerging markets in Asia-Pacific and mature, efficiency-oriented markets in Europe and North America.

By 2035, the market's regional dynamics will reflect Asia-Pacific as the primary growth engine, while Europe and North America will contribute through incremental modernization and technology integration rather than volume expansion.

Quick Stats for Road Haulage Market

- Road Haulage Market Value (2025): USD 4.0 billion

- Road Haulage Market Forecast Value (2035): USD 7.3 billion

- Road Haulage Market Forecast CAGR: 6.0%

- Leading Segment in Road Haulage Market in 2025: Domestic (58.7%)

- Key Growth Regions in Road Haulage Market: North America, Asia-Pacific, Europe

- Top Players in Road Haulage Market: UPS Freight, FedEx Freight, DHL Freight, XPO Logistics, C.H. Robinson, J.B. Hunt Transport Services, Schneider National

Road Haulage Market Key Takeaways

| Road Haulage Market Estimated Value in (2025 E) | USD 4.0 billion |

| Road Haulage Market Forecast Value in (2035 F) | USD 7.3 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

The road haulage market is a core component of the global freight and logistics sector, serving as the backbone of overland goods transport.

Within the global logistics industry, it represents about 22.5%, highlighting its dominant role in supply chain activity. In the freight transportation market, its share is estimated at 27.8%, supported by widespread use for short and long-distance cargo delivery. Within the commercial trucking industry, road haulage accounts for around 24.3%, reflecting dependence on heavy-duty and light-duty trucks.

In the e-commerce logistics segment, it holds 18.6%, driven by last-mile and regional distribution needs. Across the industrial goods movement sector, its presence is about 20.4%, ensuring consistent flow of raw materials and finished products. Recent trends in the road haulage market have been influenced by digital transformation, fleet modernization, and sustainability-focused strategies.

Groundbreaking developments include the integration of telematics, AI-based route optimization, and predictive analytics for improved efficiency. Key players are adopting electric and alternative fuel-powered fleets to reduce emissions and operating costs. Strategic collaborations with technology firms have been pursued to deploy autonomous truck trials and smart freight platforms.

Demand for real-time visibility has accelerated the adoption of IoT-enabled tracking systems and blockchain-based documentation. Companies are also focusing on modular trailer designs and capacity-sharing networks to maximize utilization. These advancements are shaping road haulage as a critical enabler of trade efficiency and resilient supply chain operations.

Why is the Road Haulage Market Growing?

The road haulage market continues to demonstrate resilience and adaptability amid evolving global trade dynamics, infrastructure developments, and technological advancements in logistics.

Growing demand for cost-effective, time-sensitive transportation solutions across both urban and rural areas has strengthened the position of road haulage as a preferred freight mode. Infrastructure enhancements and the expansion of road networks in developing economies are further accelerating market momentum. In addition, digital integration in fleet management, including route optimization and real-time tracking, is improving efficiency and reducing operational costs.

Looking ahead, the market is set to benefit from increased demand in sectors such as automotive, construction, and FMCG, as well as the growing trend of e-commerce. A stable regulatory environment and heightened investments in sustainable transportation practices are expected to support long-term growth while aligning operations with global emission reduction goals

Segmental Analysis

The road haulage market is segmented by type, vehicle, end-user, and geographic regions. By type, road haulage market is divided into domestic and international.

In terms of vehicle, road haulage market is classified into heavy, medium, and light. Based on end-user, road haulage market is segmented into automotive, manufacturing, healthcare, retail, food beverages, mining & construction, oil & gas, and others. Regionally, the road haulage industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Insights into the Domestic Segment

The domestic segment holds a leading 58.7% share in the road haulage market, driven by the rising need for short-to-medium range logistics solutions that ensure fast and reliable delivery. Domestic haulage plays a critical role in supporting local economies by facilitating intra-country trade, regional supply chain integration, and last-mile distribution. The segment's dominance is reinforced by the increasing frequency of shipments, particularly in the retail, FMCG, and agricultural sectors.

Businesses rely heavily on domestic haulage providers for inventory replenishment, factory-to-warehouse logistics, and intercity transfers. Enhanced government focus on improving national road infrastructure and streamlining cross-state logistics operations has bolstered service efficiency and fleet mobility. The ongoing adoption of digital tools for tracking, billing, and compliance monitoring is expected to strengthen the competitiveness of domestic haulage services, sustaining their growth as regional economies scale

Insights into the Heavy Vehicle Segment

Heavy vehicles account for 43.5% of the vehicle category within the road haulage market, reflecting their critical role in transporting high-volume and long-distance freight. This segment continues to dominate due to its capacity to handle bulk cargo and facilitate industrial-scale logistics operations across key economic sectors. Industries such as construction, mining, and manufacturing depend on heavy haulage to ensure timely delivery of raw materials, components, and finished goods.

The segment has also seen rising demand for high-axle, fuel-efficient models that reduce operational costs and increase payload efficiency. Regulatory incentives promoting fleet modernization and the introduction of low-emission heavy vehicles are further influencing buyer behavior. As international trade and cross-border freight volumes grow, heavy vehicles are expected to remain indispensable in meeting logistical needs, supporting the segment's sustained prominence in the market

Insights into the Automotive End-user Segment

The automotive sector represents 22.9% of the end-user segment in the road haulage market, highlighting its reliance on timely and coordinated logistics to support just-in-time manufacturing and distribution. Road haulage is essential in transporting components, assemblies, and finished vehicles between production plants, warehouses, dealerships, and ports. The complexity of the automotive supply chain requires high-frequency, multi-stop, and time-sensitive delivery capabilities that road transport is uniquely positioned to fulfill.

As automotive manufacturing expands into new regions and production scales rise, logistics providers are increasingly integrating real-time tracking, automation, and RFID-based cargo verification to meet OEM demands. Additionally, the rise of electric vehicle (EV) production and associated components such as battery packs has introduced specialized transportation needs that further support road haulage growth. Continued globalization of automotive supply chains and the sector's reliance on high-speed land-based transport are expected to uphold road haulage demand in this end-user category

What are the Drivers, Restraints, and Key Trends of the Road Haulage Market?

The market has witnessed significant expansion driven by the growing demand for transportation of goods across regions, supported by industrial growth, e-commerce, and logistical improvements.

Road haulage services are used extensively for last-mile delivery, intercity freight, and supply chain operations, ensuring timely distribution of raw materials, finished goods, and retail products. Investments in highway infrastructure, modernization of trucking fleets, and adoption of fleet management technologies have improved efficiency, safety, and reliability. The environmental regulations and fuel efficiency standards have influenced operational strategies, encouraging the adoption of low-emission and technologically advanced vehicles.

Fleet Modernization and Technology Adoption

Road haulage operators are increasingly modernizing fleets to improve efficiency, reduce maintenance costs, and comply with emission standards.

Advanced vehicles equipped with telematics, GPS tracking, automated route optimization, and predictive maintenance systems are being deployed to reduce operational delays and enhance fuel efficiency. Fleet management software enables real-time monitoring of vehicle performance, driver behavior, and delivery schedules, allowing logistics companies to optimize routes, reduce idle times, and lower operational costs. The integration of Internet of Things (IoT) solutions and automated load tracking improves transparency and accountability across supply chains.

Such technological adoption has strengthened competitiveness and enabled service providers to meet rising customer expectations for timely, safe, and cost-effective road freight solutions.

E-commerce Growth Driving Last-Mile Transportation

The rapid expansion of e-commerce has created significant demand for road haulage services, particularly for last-mile delivery. Online retail, food distribution, and consumer goods delivery require flexible, reliable, and timely transport solutions. Road haulage companies have expanded their urban networks to accommodate smaller, frequent shipments and adapted operations for on-demand delivery models.

Investments in temperature-controlled trucks and parcel-specific vehicles support the transport of perishable and high-value goods. Integration with digital logistics platforms enables route optimization, load consolidation, and predictive scheduling. The surge in e-commerce transactions has increased demand for urban delivery infrastructure, resulting in greater adoption of technologically advanced road haulage services capable of handling fluctuating volumes efficiently.

Infrastructure Development and Cross-Border Operations

Infrastructure improvements, such as the expansion of highways, expressways, and dedicated freight corridors, have enabled faster, safer, and more cost-effective road haulage.

Cross-border freight operations have benefited from streamlined customs processes, electronic documentation, and harmonized regulations, allowing operators to reduce delays and optimize delivery schedules. Investments in parking, rest stops, and maintenance facilities have enhanced operational efficiency, particularly for long-haul trucking. Road haulage companies are strategically expanding hubs and depots along major trade corridors to reduce transit times and increase fleet utilization.

Improved road connectivity and regulatory alignment have strengthened the efficiency of both domestic and international haulage, supporting the growth of trade and industrial supply chains.

Regional Market Dynamics and Competitive Landscape

Asia Pacific dominates the road haulage market due to industrial growth, rising manufacturing output, and increased urbanization, leading to higher freight demand. Europe emphasizes sustainability, fleet modernization, and regulatory compliance, whereas North America focuses on long-haul efficiency, technology integration, and advanced logistics solutions. Key market players invest in electric and alternative fuel vehicles, digital fleet management, and strategic partnerships to enhance service coverage and efficiency.

Competitive strategies include route optimization, operational cost reduction, and adoption of advanced telematics. Regional demand is shaped by infrastructure investment, industrial expansion, urban delivery requirements, and regulatory frameworks governing road transport and safety standards, ensuring steady market growth globally.

Analysis of Road Haulage Market By Key Countries

| China | 8.1% |

| India | 7.5% |

| Germany | 6.9% |

| France | 6.3% |

| UK | 5.7% |

| USA | 5.1% |

| Brazil | 4.5% |

The market is expected to expand at a CAGR of 6.0% from 2025 to 2035. India reaches 7.5%, driven by growing logistics demand and freight infrastructure improvements.

China leads at 8.1%, supported by extensive highway networks and increasing commercial transport volumes. Germany records 6.9%, reflecting efficiency-focused transport solutions and modern fleet adoption. The UK stands at 5.7% with ongoing road network upgrades, while the USA at 5.1% benefits from regional and interstate transport investments.

These developments highlight the critical role of road haulage in connecting markets and supporting global trade. This report includes insights on 40+ countries; the top markets are shown here for reference.

Expansion of Road Haulage Market in China

China is projected to grow at a CAGR of 8.1%, supported by expanding logistics networks, rising e-commerce shipments, and infrastructure development of highways and expressways. The adoption of digital fleet management, GPS tracking, and route optimization technologies has enhanced efficiency across commercial transport.

Road haulage operators focus on integrating advanced telematics and fuel-efficient vehicles to meet growing freight demand. Collaborative initiatives between local fleet operators and international logistics providers are strengthening last-mile delivery capabilities and optimizing supply chain performance.

Market Growth of Road Haulage in India

India is expected to expand at a CAGR of 7.5%, driven by increasing freight volumes, road network upgrades, and the growing demand for organized logistics. Highway expansions and expressway projects facilitate faster movement of goods across states.

Adoption of fleet management systems and digital tracking solutions enhances delivery efficiency and reduces downtime. E-commerce growth and intercity logistics services are major contributors. Both domestic and international operators are modernizing fleets to meet rising demand and regulatory compliance.

Road Haulage Market Dynamics in Germany

Germany, with a CAGR of 6.9%, benefits from a mature logistics sector, strong industrial base, and well-developed autobahn network. Road haulage supports both domestic distribution and cross-border freight across Europe. Adoption of telematics, electric and hybrid trucks, and fleet optimization technologies improves operational efficiency and reduces carbon impact.

Regulatory compliance, safety standards, and integration with multimodal transport systems are key drivers of market growth.

Future Outlook on Road Haulage in the United Kingdom

The United Kingdom is projected to grow at a CAGR of 5.7%, driven by e-commerce, intercity freight, and modernization of fleet infrastructure. Operators are increasingly using telematics, route optimization, and fuel-efficient trucks to improve profitability. Demand from retail and industrial sectors is concentrated in metropolitan regions, while investment in smart logistics hubs enhances delivery networks.

Focus on low-emission vehicles is also emerging as a priority in compliance with environmental regulations.

Road Haulage Market Trends in the United States

The United States market is growing at a CAGR of 5.1%, reflecting steady expansion in freight transportation and adoption of advanced fleet management. Demand is fueled by intercity and regional logistics, e-commerce distribution, and supply chain modernization.

The United States market is growing at a CAGR of 5.1%, reflecting steady expansion in freight transportation and adoption of advanced fleet management. Demand is fueled by intercity and regional logistics, e-commerce distribution, and supply chain modernization.

Operators increasingly deploy GPS tracking, fuel-efficient vehicles, and digital monitoring platforms to optimize routes. Integration with rail and port logistics enhances multimodal efficiency, while regulatory compliance drives adoption of emission-reduction technologies.

Competitive Landscape of Road Haulage Market

The market is dominated by a combination of global logistics leaders and regional specialists that provide freight transport solutions across diverse industries.

The market is dominated by a combination of global logistics leaders and regional specialists that provide freight transport solutions across diverse industries.

UPS Freight, FedEx Freight, and DHL Freight lead the market with extensive distribution networks, integrated supply chain services, and advanced tracking technologies, enabling reliable and timely delivery for domestic and cross-border operations. Their strong brand recognition and global presence allow them to secure large contracts with multinational companies. XPO Logistics, C.H.

Robinson, and J.B. Hunt Transport Services compete by offering flexible solutions such as dedicated fleets, intermodal transport, and temperature-controlled logistics, catering to specialized freight needs. Schneider National enhances competitiveness through technology-driven fleet management, route optimization, and scalable service options for regional and national clients.

Market competitiveness is increasingly shaped by the adoption of digital freight platforms, real-time tracking systems, and predictive logistics analytics. Rising fuel costs, regulatory compliance, and sustainability pressures are driving companies to invest in fuel-efficient fleets and alternative energy vehicles. Strategic partnerships with shippers, integration of value-added services, and focus on operational efficiency remain central to maintaining market share in this dynamic and highly service-oriented sector.

Key Players in the Road Haulage Market

- UPS Freight

- FedEx Freight

- DHL Freight

- XPO Logistics

- C.H.

Robinson

- J.B. Hunt Transport Services

- Schneider National

Scope of the Report

| Quantitative Units | USD 4.0 billion |

| Type | Domestic and International |

| Vehicle | Heavy, Medium, and Light |

| End-user | Automotive, Manufacturing, Healthcare, Retail, Food Beverages, Mining & Construction, Oil & Gas, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | UPS Freight, FedEx Freight, DHL Freight, XPO Logistics, C.H. Robinson, J.B.

Hunt Transport Services, and Schneider National |

| Additional Attributes | Dollar sales by vehicle type and cargo category, demand dynamics across freight, logistics, and last-mile delivery sectors, regional trends in road transport infrastructure and fleet modernization, innovation in fuel efficiency, telematics, and safety systems, environmental impact of emissions and fuel consumption, and emerging use cases in e-commerce logistics, cold chain transport, and multimodal integration. |