Hydraulic Fracturing Dual Engine Systems Market Size And Share Report by 2034

Hydraulic Fracturing Dual Engine Systems Market Overview

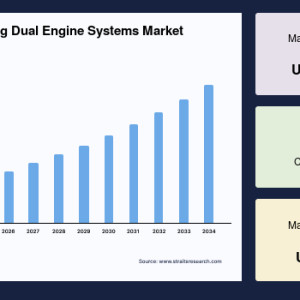

The global hydraulic fracturing dual engine systems market size is estimated at USD 580 million in 2025 and is anticipated to grow from USD 610 million in 2026 till USD 900 million by 2034, growing at a CAGR of 5% from 2026-2034. The global hydraulic fracturing dual engine systems market growth is attributed to the industry's shift from traditional diesel-only systems to more advanced dual-engine and electrically assisted platforms to lower fuel cost and emissions while maintaining uptime and transient response. Additionally, policy initiatives such as emissions targets and the increasing availability of field gas as a lower-cost fuel alternative encourage OEMs to invest in the development of retrofit kits, new dual-fuel engines, and hybrid or electric fracturing platforms.

Key Market Insights

- North America held a dominant share of the global market with a market share of 38.1% in 2025.

- The Asia Pacific region is growing at the fastest pace, with a CAGR of 12.32%.

- Based on configuration, the dual-fuel retrofit kits are estimated to grow at a CAGR of 15%.

- Based on end user, pressure-pumper service companies led by market share in 2025.

- The U.S. dominates the market in 2025.

Market Size & Forecast

- 2025 Market Size: USD 580 million

- 2034 Projected Market Size: USD 900 million

- CAGR (2026-2034): 5%

- Dominating Region: North America

- Fastest-Growing Region: Asia Pacific

Market Trends

Rapid Rollout of Dual-Fuel Retrofit and Dynamic Gas-Blending Kits

There is a strong move to convert existing diesel engines in fracturing fleets into dual-fuel systems that can burn a blend of natural gas and diesel.

These retrofit kits allow much of the diesel to be replaced when field gas or cheaper pipeline gas is available, yet maintain diesel backup for peak loads.

- For instance, in December 2024, ProPetro Holdings launched its ProPWR subsidiary, planning mobile natural gas-fueled power generation for electric hydraulic fracturing services under contracts in the Permian Basin, delivering around 110 MW of equipment between mid-2025 and early 2026.

This trend lowers upfront cost compared to replacing whole fleets, enabling a more gradual transition and faster environmental benefits.

Electrification and Integrated Site Power Grids

The industry is increasingly adopting electric fracking ("e-frac") and integrated site-power solutions combining electric drives, onsite generators or microgrids, and automation.

- For instance, in May 2025, Halliburton's ZEUS IQ platform and its joint Octiv Auto-Frac deployments illustrate electric pumping with digital controls and onsite power architectures that reduce fuel use and emissions.

Electrification improves precision and reduces emissions but raises demands for a reliable power supply, capital investment in electrical infrastructure, and safety systems. It complements dual-fuel kits, especially in regions with lower power costs or good grid access.

Hydraulic Fracturing Dual Engine Systems Market Drivers

Fuel Economics and Access to Field Gas

One of the biggest drivers for dual-engine systems is the cost difference between diesel and natural gas. When sites have access to produced or pipeline gas at significantly lower cost, replacing diesel becomes financially attractive.

In many North American plays, producers and completion contractors can tap produced gas or local gas supply to feed dual-fuel engines or gas-powered generators.

- In January 2025, Cummins announced a partnership with Liberty Energy to deploy a large, variable-speed natural gas engine on its digiPrime fracturing platform.

This shows OEMs are responding by offering engines optimized for field gas. Fuel savings, fewer diesel deliveries, and lower emissions help operators justify investment when utilization is high and gas supply is reliable.

Emissions Regulation and Operator ESG Commitments

Regulations and corporate environmental, social, and governance (ESG) targets are pushing operators to reduce emissions from fracturing operations. Dual-fuel and electrified systems lower CO2, NOx, and particulates compared to pure diesel fleets.

Manufacturers are making commitments for fleet upgrades and low-emission completions.

- For instance, in February 2025, Caterpillar's public messaging around its Gen-2 DGB kit explicitly linked it to emissions reduction goals.

These requirements make OEMs and service providers see dual-fuel and electric options as increasingly necessary for regulatory compliance, public acceptance, and access to contracts tied to sustainability.

Market Restraint

Operational Complexity and Gas Quality/Supply Logistics

Despite benefits, dual-engine solutions face difficulties from gas supply issues and logistical hurdles. Field gas often varies in composition (moisture, contaminants, H2S), so adequate treatment or conditioning equipment is needed. Some retrofit kits require substantial control and calibration changes.

Operators without a reliable gas supply may revert to diesel, undermining savings. In 2024-2025, several contractors reported delays or abandonments of retrofit projects due to gas quality or gas-infrastructure constraints. These complexities increase cost and risk, extending deployment timelines.

Market Opportunity

Retrofitting Legacy Fleets for Near-Term Emissions and Cost Wins

A major opportunity in the hydraulic fracturing dual-engine systems market lies in retrofitting existing diesel fleets with dual-fuel kits.

Many operators own large fleets of diesel fracking rigs. Retrofitting these fleets with dual-fuel kits offers immediate fuel cost savings and emission reductions without replacing entire fleets.

- For instance, launched in February 2025, Caterpillar's Dynamic Gas Blending (DGB) Gen-2 kit allows ~70-85% diesel displacement on Tier-2 engines while maintaining diesel as a backup for reliability.

These retrofit opportunities generate aftermarket and service revenues, and allow incremental improvement while operators and OEMs plan larger electrification or dual-engine fleet investments.

- ? Preview Report Scope and Structure - Gain immediate visibility into key topics, market segments, and data frameworks covered.

- ?

Evaluate Strategic Insights - Access selected charts, statistics, and analyst-driven commentary derived from the final report deliverables.

Regional Analysis

North America remains the largest and most advanced market for dual-engine fracturing systems. The region benefits from a high concentration of shale plays, abundant access to produced gas, and a mature service ecosystem. Using natural gas instead of diesel creates strong economic incentives, particularly in basins like the Permian.

Beyond economics, ESG commitments and air-quality concerns drive operators to modernize fleets. Although drilling activity fluctuates with commodity prices, the U.S. and Canada remain the global hub for commercializing and scaling dual-engine technologies. The United States remains the global leader in hydraulic fracturing and in the adoption of dual-engine and hybrid fleets.

The growth is driven by abundant access to produced and pipeline gas, high fleet utilization in shale plays such as the Permian, Eagle Ford, and DJ Basin, and regulatory pressure for cleaner operations. Service companies are rapidly upgrading fleets with retrofit kits and new-build gas engines. With strong infrastructure, high activity levels, and ESG-driven operator commitments, the U.S. continues to set the pace for innovation and deployment of dual-engine systems.

Canada market shows steady progress, especially in gas-rich provinces such as Alberta and British Columbia. The country's abundant natural gas supply, combined with provincial carbon pricing schemes, provides strong motivation to replace diesel-heavy fleets with dual-fuel or electrified systems. Contractors are beginning to trial retrofit kits and electrified pumps to meet corporate ESG targets.

Provincial incentives and clean-technology programs also help offset the costs of these upgrades.

Asia-Pacific Hydraulic Fracturing Dual Engine Systems Market Trends

The Asia-Pacific region shows the fastest growth potential, fueled by China and India's push to develop unconventional resources. China, through Sinopec and PetroChina, set records in 2024-2025 for shale well completions, creating demand for dual-fuel and electrified fleets. Operators in gas-rich regions are finding quick financial paybacks by displacing diesel with cheaper domestic gas.

Electrification pilots remain smaller than in North America but are emerging as governments push for emissions reduction. The region's large resource base makes it the key frontier for expansion. China is becoming one of the fastest-growing regions for dual-engine fracturing systems, mainly due to the government's push to develop domestic shale resources and reduce reliance on imports.

State policy, aligned with carbon peaking and neutrality goals, is encouraging operators to adopt cleaner equipment. Local OEMs are also collaborating with international firms to bring retrofit kits and gas-handling systems into the domestic market. With strong government backing, expanding unconventional programs, and an industrial policy that promotes domestic manufacturing, China represents one of the largest future markets.

India hydraulic fracturing sector is still emerging, with unconventional resource development in very early stages. Government policy is more focused on expanding gas infrastructure, boosting renewables, and improving energy security than on large-scale fracking. Nevertheless, there is growing interest in exploring shale and tight gas basins, with cleaner technologies such as dual-fuel engines seen as a way to minimize environmental concerns.

Germany Hydraulic Fracturing Dual Engine Systems Market Trends

Germany plays an important role in the global market as a supplier and technology hub.

German firms contribute engines, control systems, and emissions technologies that power fleets abroad. Germany's role is not to deploy dual-engine systems but to export high-performance components to markets like the U.S., Canada, and China. German engineering experts in hybrid power, emissions controls, and digital automation find applications in completed fleets worldwide.

There is also ongoing R&D interest in developing low-emission equipment for energy transition needs, such as hydrogen-capable combustion systems and advanced electrical drive technologies.

Configuration Insights

Dual-fuel retrofit kits dominate the market because they allow operators to convert existing diesel fleets into dual-fuel engines at a lower capital cost. These systems, especially newer dynamic gas-blending kits such as Caterpillar's Gen-2, can replace 70-85% of diesel use with natural gas while maintaining reliable performance. The key growth driver is cost savings where produced or pipeline gas is available, making payback periods shorter compared to new fleet purchases.

Despite gas-quality challenges, retrofits remain the most practical near-term pathway.

Engine Insights

Large variable-speed natural-gas engines[1] are the dominant segment because they are specifically designed for the torque and duty cycle of fracturing operations. Unlike retrofits, these engines operate more reliably with varying field gas compositions and can deliver consistent performance with lower emissions and cost per unit of energy. Regions with dependable gas access show growth in this segment, as these engines reduce diesel dependence and avoid some reliability challenges of blended systems.

OEM investment in turnkey platforms further supports adoption.

Fuel Mix Insights

Diesel and produced natural gas are the main fuel combinations because produced gas is often the most readily available and lowest-cost onsite fuel and is otherwise wasted. Using it lowers operating costs, reduces diesel deliveries, and cuts emissions. The growth is tied to the diesel-gas price spread, when gas is cheap relative to diesel, the payback period for dual-fuel systems shortens significantly.

The produced gas pathway remains dominant because it leverages an otherwise stranded resource and offers immediate OPEX leverage.

End User Insights

Pressure-pumper contractors drive most purchases because they control frac fleets and directly benefit from reduced fuel costs. Contractors can spread retrofit or new-build investments across multiple operator jobs, making adoption more economically viable. Major service companies like Liberty and ProFrac invested in dual-fuel and electric platforms, reinforcing their role as fleet-modernisation leaders.

Contractors also generate ongoing aftermarket demand for installation, gas conditioning, and maintenance services, shaping supplier strategies.

Competitive Landscape

The global market is highly fragmented, shaped by a mix of OEMs, engine manufacturers, retrofit specialists, and service contractors. Large OEMs supply retrofit kits and purpose-built gas engines, while contractors act as the primary buyers and integrators. OEMs continue to promote long-term solutions like new gas-powered rigs and fully electrified fleets.

Caterpillar has built a strong position in the dual-engine market by focusing on retrofit kits and aftersales services. Its strategy is to tap into the large installed base of diesel frac engines and help contractors transition gradually to dual-fuel systems. The company's DGB Gen-2 kit allows Tier-2 diesel engines[2] to displace up to 85% of diesel with natural gas, while keeping diesel backup for reliability.

This positions Caterpillar as a preferred partner for contractors seeking cost savings without replacing entire fleets.

Latest News

- In February 2025, Caterpillar announced commercial availability of its DGB Gen-2 retrofit kit, which improves fuel flexibility and emissions performance, highlighting its role in enabling operators to meet both cost and ESG targets.

List of key players in Hydraulic Fracturing Dual Engine Systems Market

- Caterpillar[3]

- Cummins

- Halliburton

- NOV

- ProFrac[4]

- Liberty Energy

- Baker Hughes

- Schlumberger (SLB)

- Sinopec Oilfield Service

- TechnipFMC

- Weatherford[5]

- Jereh Group

- Hyundai Doosan Infracore

- MTU/Rolls-Royce Power Systems

- Wartsila

- Aramco

- Wajax

- Atlas Copco

Recent Developments

- June 2025 - Halliburton[6] announced a collaboration with Chevron to develop a new process that enables closed-loop, feedback-driven completions.

This new approach integrates Halliburton's ZEUS IQ intelligent fracturing platform, which combines the company's all-electric ZEUS pumping units, OCTIV automation, and Sensori subsurface monitoring.

- January 2025 - Cummins and Liberty Energy agreed to deploy a variable-speed natural-gas engine on Liberty's digiPrime fracturing platform.

This is a purpose-built gas engine deployment, representing newer dual-engine fleet activity beyond retrofit kits.

Hydraulic Fracturing Dual Engine Systems Market Segmentations

By Configuration (2022-2034)

- Dual-fuel retrofit kits (fumigation / port injection / dynamic gas blending)

- Purpose-built dual-engine rigs (two internal-combustion engines working in tandem)

- Hybrid diesel-electric / diesel + battery assist dual-engine systems

- Fully electrified systems with backup engine (electric primary + diesel/gas backup)

By Engine (2022-2034)

- Large displacement gas engines (variable speed, field-gas optimised)

- Diesel engines with gas-blend capability (retrofitted)

- Electric motor drives fed by onsite generators / microgrids

By Fuel Mix (2022-2034)

- Diesel + produced natural gas (dual-fuel)

- Diesel + pipeline natural gas

- Grid or generator electricity + diesel backup (electrified hybrid)

- Battery + generator hybrids

By End User (2022-2034)

- Pressure-pumper service companies (contractors)

- Integrated well-owner/operators (in-house fleets)

- EPC / turnkey electrification integrators

By Region (2022-2034)

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Spain

- Italy

- Russia

- Nordic

- Benelux

- Rest of Europe

- APAC

- China

- Korea

- Japan

- India

- Australia

- Taiwan

- South East Asia

- Rest of Asia-Pacific

- Middle East and Africa

- UAE

- Turkey

- Saudi Arabia

- South Africa

- Egypt

- Nigeria

- Rest of MEA

- LATAM

- Brazil

- Mexico

- Argentina

- Chile

- Colombia

- Rest of LATAM

Frequently Asked Questions (FAQs)

The global hydraulic fracturing dual engine systems market size is estimated at USD 580 million in 2025 and is anticipated to grow from USD 610 million in 2026 till USD 900 million by 2034.

Fuel economics and access to field gas and Emissions regulation and operator ESG commitments are some of the factors driving the growth of the market.

Top key players are Caterpillar, Cummins, Halliburton, NOV, ProFrac, Liberty Energy, Baker Hughes, Schlumberger (SLB), Sinopec Oilfield Service, TechnipFMC, Weatherford, Jereh Group, Hyundai Doosan Infracore, MTU/Rolls-Royce Power Systems, Wartsila, Aramco, Wajax, Atlas Copco.

North America dominates the global hydraulic fracturing dual engine systems market.

Dual-fuel retrofit kits segment dominate the market.

References

- ^ gas engines (straitsresearch.com)

- ^ diesel engines (straitsresearch.com)

- ^ Caterpillar (www.caterpillar.com)

- ^ ProFrac (profrac.com)

- ^ Weatherford (www.weatherford.com)

- ^ Halliburton (www.halliburton.com)