Cross-Border Road Transport Market

Cross-Border Road Transport Market Size and Share Forecast Outlook 2025 to 2035

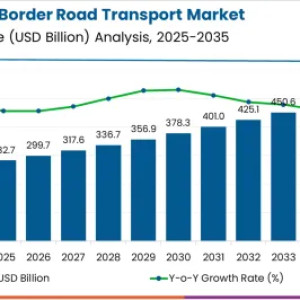

The cross-border road transport market, valued at USD 282.7 billion in 2025 and projected to reach USD 506.3 billion by 2035 at a CAGR of 6.0%, displays uneven regional growth trajectories shaped by trade flows, infrastructure readiness, and regulatory harmonization. Asia-Pacific is expected to witness the fastest expansion, supported by large-scale infrastructure projects under regional initiatives such as the Belt and Road framework. The market in this region benefits from increasing intra-regional trade, rapid logistics digitalization, and growing demand for efficient freight corridors that link inland production hubs with major ports.

Europe, while supported by a mature transport network, faces moderate growth as the region already maintains integrated cross-border logistics through the European Union's single market policies. The environmental regulations and the push toward decarbonization of freight transport are likely to demand significant investments in fleet modernization and alternative fuel vehicles. North America demonstrates steady expansion, largely tied to the USMCA trade framework and increasing freight demand between the US, Mexico, and Canada.

Infrastructure bottlenecks at key border points may restrain efficiency, but digital border management and advanced fleet technologies are being gradually adopted. Asia-Pacific is expected to outperform in momentum, while Europe and North America will sustain growth under tighter regulatory and environmental constraints.

Quick Stats for Cross-Border Road Transport Market

- Cross-Border Road Transport Market Value (2025): USD 282.7 billion

- Cross-Border Road Transport Market Forecast Value (2035): USD 506.3 billion

- Cross-Border Road Transport Market Forecast CAGR: 6.0%

- Leading Segment in Cross-Border Road Transport Market in 2025: Freight transport (59.4%)

- Key Growth Regions in Cross-Border Road Transport Market: North America, Asia-Pacific, Europe

- Top Key Players in Cross-Border Road Transport Market: DHL Supply Chain, FedEx Corporation, United Parcel Service (UPS), DB Schenker, Kuehne + Nagel, C.H. Robinson, Nippon Express, J.B.

Hunt Transport Services, Ryder System, XPO Logistics

Cross-Border Road Transport Market Key Takeaways

| Cross-Border Road Transport Market Estimated Value in (2025 E) | USD 282.7 billion |

| Cross-Border Road Transport Market Forecast Value in (2035 F) | USD 506.3 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

The cross border road transport market represents a vital segment within the global logistics and freight movement industry, emphasizing connectivity, trade facilitation, and supply chain reliability. Within the overall road freight transport market, it accounts for about 6.1%, reflecting its role in linking regional and international trade corridors. In the global logistics and supply chain management sector, it holds nearly 5.4%, supported by cross-border commerce and just-in-time delivery models.

Across the commercial vehicle and trucking industry, the segment captures 4.7%, driven by demand for long-haul fleets and specialized transport solutions. Within the international trade facilitation and customs services category, it represents 3.8%, highlighting integration with customs clearance and regulatory compliance. In the regional economic integration and trade infrastructure sector, it secures 4.2%, underscoring its contribution to bilateral and multilateral trade expansion.

Recent developments in this market have focused on digital freight platforms, regulatory harmonization, and fleet modernization. Innovations include cross-border digital logistics platforms enabling real-time cargo tracking, electronic documentation, and customs pre-clearance. Key players are collaborating with governments and regional trade bodies to enhance connectivity and reduce border delays.

Adoption of fuel-efficient trucks, alternative fuels, and telematics is increasing to improve cost efficiency and reduce environmental impact. The strategic investments are being made in dedicated trade corridors and infrastructure upgrades to boost cross border capacity. These trends demonstrate how digitalization, policy coordination, and operational efficiency are shaping the cross border road transport market.

Why is the Cross-Border Road Transport Market Growing?

The cross-border road transport market is expanding steadily, supported by the growth of international trade, regional economic integration, and infrastructure development aimed at enhancing overland connectivity.

Trade agreements and harmonized regulatory frameworks have facilitated smoother customs clearance and reduced transit times, increasing the efficiency of road-based logistics. Industry reports and transport sector updates have indicated rising demand for flexible and cost-effective shipping solutions that can handle diverse cargo types and offer door-to-door delivery. Technological integration, including GPS tracking, fleet management systems, and digital documentation, has further improved operational transparency and reduced administrative bottlenecks.

The market is also benefiting from the increasing adoption of multimodal transport networks, where road transport plays a pivotal role in the first and last mile of cross-border logistics. Over the forecast period, growth is expected to be driven by continued investments in border infrastructure, the expansion of trade corridors, and demand from key sectors such as manufacturing, retail, and agriculture, with freight transport, non-perishable goods, and manufacturing end-users expected to lead segmental growth.

Segmental Analysis

The cross-border road transport market is segmented by transportation mode, cargo type, end-user, and geographic regions. By transportation mode, cross-border road transport market is divided into Freight transport and Passenger transport.

In terms of cargo type, cross-border road transport market is classified into Non-perishable goods, Perishable goods, and Specialized cargo. Based on end-user, cross-border road transport market is segmented into Manufacturing, Retail and e-commerce, Automotive, Agriculture, Pharmaceuticals & healthcare, Oil & gas, Defense and military logistics, Individual, and Others. Regionally, the cross-border road transport industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Insights into the Transportation Mode Segment: Freight Transport

The freight transport segment is projected to hold 59.4% of the cross-border road transport market revenue in 2025, maintaining its dominance due to its versatility and capacity to serve diverse industries. This segment's growth has been supported by the need for reliable movement of goods across borders, particularly in regions where road networks provide faster and more direct access than rail or maritime options. Freight transport operators have benefited from improved fleet efficiency, better route optimization, and expanded vehicle capacities, enabling them to handle higher cargo volumes with reduced transit times.

Additionally, the segment's adaptability in managing various cargo sizes and its ability to integrate with multimodal transport systems have reinforced its importance in cross-border trade. The consistent demand for freight transport services from manufacturing, retail, and agricultural sectors ensures the segment's sustained leadership.

Insights into the Cargo Type Segment: Non-perishable Goods

The non-perishable goods segment is projected to account for 46.8% of the cross-border road transport market revenue in 2025, reflecting its central role in sustaining high shipment volumes across borders.

The non-perishable goods segment is projected to account for 46.8% of the cross-border road transport market revenue in 2025, reflecting its central role in sustaining high shipment volumes across borders.

This segment's strength has been driven by the consistent demand for goods such as machinery, textiles, construction materials, and consumer products, which require secure yet non-temperature-controlled transport solutions. Road transport providers have been able to optimize loading capacities, reduce handling costs, and improve delivery schedules for these goods, making them a preferred choice for shippers. Furthermore, trade expansion in durable goods sectors and reduced dependency on specialized refrigerated infrastructure have facilitated smoother cross-border logistics.

The segment's growth is also supported by the increasing integration of supply chains across neighboring countries, allowing for steady shipment flows year-round.

Insights into the End-User Segment: Manufacturing

The manufacturing segment is projected to contribute 28.7% of the cross-border road transport market revenue in 2025, establishing itself as the leading end-user category. Growth in this segment has been fueled by the globalization of manufacturing supply chains and the need for timely delivery of components, raw materials, and finished products.

The manufacturing segment is projected to contribute 28.7% of the cross-border road transport market revenue in 2025, establishing itself as the leading end-user category. Growth in this segment has been fueled by the globalization of manufacturing supply chains and the need for timely delivery of components, raw materials, and finished products.

Road transport offers manufacturers flexibility in shipment sizes, faster transit for just-in-time inventory systems, and reliable access to both domestic and export markets. Industrial clusters near borders have leveraged road transport for efficient sourcing and distribution, reducing lead times and operational costs. Additionally, cross-border collaborations between manufacturing firms have increased the movement of intermediate goods, further boosting demand.

With manufacturing output continuing to expand in both developed and emerging economies, this segment is expected to sustain its role as a primary driver of cross-border road transport demand.

What are the Drivers, Restraints, and Key Trends of the Cross-Border Road Transport Market?

The market has gained strategic importance as international trade, regional integration, and supply chain connectivity continue to expand. This market supports the movement of goods and passengers across international borders by road, enabling economic cooperation and trade efficiency. Infrastructure development, harmonized regulatory frameworks, and bilateral agreements have improved cross-border traffic flow.

Growing demand for just-in-time deliveries, e-commerce logistics, and perishable goods transportation has reinforced the reliance on road-based corridors. Despite challenges such as customs delays, fuel costs, and regulatory fragmentation, the market remains a vital enabler of global commerce.

Trade Growth and Regional Connectivity Drive Market Expansion

Trade growth and regional connectivity have been significant forces behind the expansion of cross-border road transport. With more than 70% of global trade volume being transported through road-based supply chains in certain regions, demand for efficient cross-border logistics has risen.

Free trade agreements, regional integration initiatives, and government-supported trade corridors have improved road infrastructure and reduced travel times. Countries have invested heavily in transnational highways, modern checkpoints, and streamlined border control systems to improve transport efficiency. Cross-border trucking has become essential for industries such as automotive, agriculture, consumer goods, and electronics, which depend on timely deliveries.

Regional initiatives such as the Belt and Road corridors and trans-European networks have created strong demand for integrated road transport services, reinforcing this market as a backbone of international trade.

Technological Integration Improves Operational Efficiency

Technological integration has enhanced efficiency in cross-border road transport through real-time tracking, digital customs management, and automated fleet monitoring. Telematics systems provide data on vehicle performance, fuel consumption, and driver behavior, improving cost efficiency and reliability. Smart border management tools, including RFID tags, e-seals, and automated clearance systems, have reduced time spent at checkpoints by nearly 30% in key trade corridors.

Logistics companies increasingly rely on route optimization software to minimize delays caused by congestion or regulatory checks. Blockchain-based platforms have been adopted to secure cargo documentation and enhance transparency. These innovations not only reduce operational costs but also build trust among stakeholders by improving cargo visibility.

Technology-driven transformation has reshaped cross-border road logistics into a faster, more resilient, and data-driven industry.

Regulatory Challenges and Infrastructure Bottlenecks

The market faces persistent challenges related to fragmented regulations and inadequate infrastructure across several regions. Differing customs procedures, border clearance standards, and transport permits often create delays that impact supply chain reliability. Infrastructure bottlenecks such as underdeveloped highways, limited parking spaces, and outdated checkpoints can significantly increase transport costs.

In some regions, inefficiencies in border clearance lead to average delays of 24 to 48 hours, creating significant financial burdens for logistics providers. The varying vehicle emission standards and driver licensing requirements across countries complicate operations for fleet owners. While regional agreements aim to improve harmonization, inconsistencies continue to slow down the adoption of seamless cross-border transport solutions.

Overcoming these challenges will require greater policy alignment, investment in modernized checkpoints, and infrastructure upgrades.

Rising Demand for Specialized Transport Services

Rising demand for specialized transport services has reshaped opportunities in cross-border road logistics. The growth of pharmaceutical, electronics, and perishable food exports has increased the need for temperature-controlled trucks, high-security vehicles, and time-sensitive delivery solutions. Cross-border e-commerce shipments have also contributed to the rising demand for express road transport services.

For instance, refrigerated trucks in international trade corridors have seen utilization rates increase by more than 40% in the past five years. Logistics providers are expanding their fleets with advanced vehicles that ensure compliance with safety and environmental regulations across multiple jurisdictions. Partnerships between logistics operators and technology firms have enabled the development of integrated services that cater to niche requirements.

The increasing complexity of global supply chains ensures that specialized cross-border road transport services remain in high demand.

Analysis of Cross-Border Road Transport Market By Key Countries

| China | 8.1% |

| India | 7.5% |

| Germany | 6.9% |

| France | 6.3% |

| UK | 5.7% |

| USA | 5.1% |

| Brazil | 4.5% |

China is projected to achieve the highest expansion in the market with a growth rate of 8.1%, supported by improved trade corridors and infrastructure modernization. India follows at 7.5%, where enhanced logistics connectivity and bilateral agreements are contributing to market development. Germany records 6.9% growth, driven by its central role in facilitating European freight and the adoption of advanced transport technologies.

The United Kingdom posts 5.7%, underpinned by regulatory adjustments and increasing freight demand. The United States shows a 5.1% growth rate, shaped by cross-border trade activities with neighboring countries and evolving transport policies. These countries highlight the ongoing evolution of cross-border road transport, where infrastructure, policy, and technology integration continue to influence market progress globally.

This report includes insights on 40+ countries; the top markets are shown here for reference.

Growth Dynamics of Cross-Border Road Transport Market in China

The market in China is anticipated to expand at a CAGR of 8.1%, supported by strong trade flows and connectivity projects under regional infrastructure programs. Demand for road freight services is being reinforced by manufacturing exports and growing cross-border e-commerce transactions. Investments in smart logistics solutions and border automation technologies are strengthening operational efficiency.

Enhanced connectivity with Southeast Asian and Central Asian trade corridors is fueling long-term opportunities. The rising use of digital freight platforms and the adoption of greener vehicles are also being recognized as significant contributors to the sector's competitiveness in China's transport ecosystem.

- High trade volumes driving demand for cross-border logistics

- Infrastructure projects connecting China with Asia and Europe

- Adoption of digital freight platforms for efficiency

Expansion Patterns of Cross-Border Road Transport Market in India

India's market is projected to register a CAGR of 7.5%, driven by growing bilateral trade agreements and improved regional connectivity. Strengthening of road networks under government initiatives is supporting faster cargo movement across borders.

Rising participation in trade with South Asian and ASEAN countries is boosting demand for reliable cross-border logistics. The adoption of GPS-enabled fleet management and automation at checkpoints is improving transparency and reducing delays. Collaborations with logistics service providers and expansion of bonded transport corridors are expected to elevate India's role in regional trade flows in the coming decade.

- Government initiatives upgrading road infrastructure

- Increased trade with South Asia and ASEAN partners

- Technology integration improving transparency in freight

Market Drivers for Cross-Border Road Transport in Germany

Germany is forecasted to grow at a CAGR of 6.9%, underpinned by its role as a logistics hub within Europe. Extensive integration with EU supply chains ensures strong reliance on cross-border trucking services. Rising exports of industrial machinery, automotive parts, and chemicals continue to sustain transport demand.

Digitization of customs procedures and adoption of connected fleet technologies are enhancing efficiency across German logistics corridors. Investments in eco-friendly transport solutions, including electric and hydrogen-powered trucks, are positioning Germany as a leader in sustainable road transport within Europe.

- Central position in EU supply chains driving logistics demand

- Growing adoption of connected fleet and digital customs systems

- Rising focus on electric and hydrogen-powered trucks

Cross-Border Road Transport Market Landscape in the United Kingdom

The market in the United Kingdom is expected to advance at a CAGR of 5.7%, shaped by adjustments in trade flows after regulatory changes in Europe. Increased documentation and customs requirements have heightened the need for streamlined logistics solutions.

Logistics firms are investing in advanced tracking systems and digital customs clearance to maintain efficiency. Growth in e-commerce exports and imports is further contributing to demand for cross-border trucking. The United Kingdom's strategic position as a trade partner with both European and global markets provides continued opportunities for expansion despite regulatory complexities.

- Customs and regulatory changes influencing logistics operations

- Investments in tracking and digital clearance solutions

- Strong role of e-commerce in boosting road transport demand

Trends in Cross-Border Road Transport Market in the United States

The market in the United States is anticipated to grow at a CAGR of 5.1%, led by trade integration with Canada and Mexico. Implementation of agreements like the USMCA has reinforced demand for cross-border freight services. Automotive, agriculture, and energy sectors are major contributors to road transport flows.

Significant investment in smart border technologies, such as electronic data interchange and automated inspection systems, is reducing transit times. Increasing emphasis on sustainable transport practices and adoption of alternative fuel trucks are also expected to influence the competitive landscape in the United States market.

- USMCA agreement boosting regional trade flows

- Smart border technology reducing transit times

- Adoption of sustainable trucks shaping market growth

Competitive Landscape of Cross-Border Road Transport Market

The market is expanding due to increased globalization of trade, integration of regional supply chains, and rising demand for time-sensitive deliveries.

The market is expanding due to increased globalization of trade, integration of regional supply chains, and rising demand for time-sensitive deliveries.

Major logistics companies such as DHL Supply Chain, FedEx Corporation, and United Parcel Service (UPS) dominate the sector with their extensive fleets, digital platforms, and integrated logistics networks. DB Schenker and Kuehne + Nagel strengthen the market by leveraging advanced route optimization, multimodal transport solutions, and cross-border compliance expertise. C.H.

Robinson focuses on technology-driven freight management, while Nippon Express enhances global connectivity through its strong Asia-Pacific and transcontinental routes. North American leaders such as J.B. Hunt Transport Services and Ryder System provide specialized solutions, including cross-docking and just-in-time delivery for industries dependent on fast supply chain flows.

XPO Logistics plays an important role with flexible cross-border trucking services and digital freight brokerage platforms. Market competition is increasingly shaped by digitalization, regulatory harmonization, and environmental standards, with companies investing in telematics, real-time tracking, and alternative-fuel fleets. As trade corridors expand across North America, Europe, and Asia, collaboration between logistics providers, governments, and trade bodies is reinforcing efficiency and resilience.

Key Players in the Cross-Border Road Transport Market

- DHL Supply Chain

- FedEx Corporation

- United Parcel Service (UPS)

- DB Schenker

- Kuehne + Nagel

- C.H.

Robinson

- Nippon Express

- J.B. Hunt Transport Services

- Ryder System

- XPO Logistics

Scope of the Report

| Quantitative Units | USD 282.7 Billion |

| Transportation Mode | Freight transport and Passenger transport |

| Cargo Type | Non-perishable goods, Perishable goods, and Specialized cargo |

| End-User | Manufacturing, Retail and e-commerce, Automotive, Agriculture, Pharmaceuticals & healthcare, Oil & gas, Defense and military logistics, Individual, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | DHL Supply Chain, FedEx Corporation, United Parcel Service (UPS), DB Schenker, Kuehne + Nagel, C.H. Robinson, Nippon Express, J.B.

Hunt Transport Services, Ryder System, and XPO Logistics |

| Additional Attributes | Dollar sales by transport service type and cargo category, demand dynamics across logistics, trade, and passenger mobility sectors, regional trends in cross-border infrastructure and policy adoption, innovation in fleet efficiency, digital tracking, and customs integration, environmental impact of fuel consumption and emissions, and emerging use cases in e-commerce logistics, just-in-time delivery, and multimodal transport solutions. |