Road transport: fairly stable traffic but morale is low

INFOGRAPHICS. The road transport sector in France starts 2025 in a delicate situation, following a particularly difficult 4th quarter of 2024.

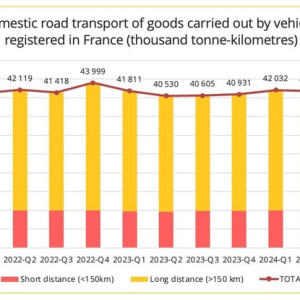

1/ Evolution of activity

(*) Domestic road transport of goods carried out by vehicles registered in France, for hire and on own account combined.

(*) Domestic road transport of goods carried out by vehicles registered in France, for hire and on own account combined.

Data source: Ministry of Transport.

- A positive third quarter

In the second quarter of 2024, domestic road freight transport activity carried out by vehicles registered in France, in data adjusted for seasonal and calendar variations, reached 41.8 billion tonne-kilometres, a fall of 0.8% compared to the previous quarter. This figure also shows a clear increase year-on-year, with a growth of 4.5% compared to Q3 2023. Traffic between an origin and a destination both located on national territory represents 95.6% of the activity. "This transport classed as domestic rebounded by 1.1%, after -1.2% in the second quarter (revised data)", indicates the economic study from the Ministry of Transport covering the third quarter of 2024, released on January 23. The French portion of the French-registered fleet's international transport activity, on the other hand, fell by 1.7%, after a sharp increase of 13.5% in the second quarter of 2024.

It represents around 1.9 billion tonne-kilometres, compared to 40.4 billion for domestic transport. After a decline of 2.5% in the previous quarter (revised data), road transport on behalf of others, which accounts for the vast majority of the activity, went up again. It increased by almost 3% quarter-on-quarter and thus stood at 37.7 billion tonne-kilometres, "its highest level since the start of 2023", indicates the Ministry of Transport.

Conversely, own-account transport decreased sharply by 13.2%, after a strong rise of 15% in the previous quarter (revised data). The mostly positive results of the 3rd quarter are consistent with the French economic growth figures. In the third quarter, GDP grew by 0.4%, boosted by an "Olympic Games" effect. However, this was not enough to restore confidence among business leaders in the road freight transport sector.

After this "Olympic interlude", economic activity slowed down. According to INSEE estimates, GDP fell by 0.1% in the 4th quarter, which obviously had consequences for road freight transport. Statistics from the Ministry of Transport on the level of activity during this period have not yet been published, but other indicators illustrate the difficulties in the sector.

Source : INSEE monthly economic survey. Between August and November 2024, the business climate in road freight transport inexorably deteriorated. It then started to rise again, but remains well below its long-term average.

Source : INSEE monthly economic survey. Between August and November 2024, the business climate in road freight transport inexorably deteriorated. It then started to rise again, but remains well below its long-term average.

The 100 point mark has not been met since November 2022.  Source : INSEE monthly economic survey.

Source : INSEE monthly economic survey.

The results are presented in the form of opinion balances for the questions with 3 modes "increasing", "stable" and "decreasing". A balance of opinion is the difference between the percentage of "increasing" responses and the percentage of "decreasing" responses. The balances of opinion on the expected development of turnover and of demand in road freight transport improved again in December 2024 and January 2025. But here again, they remain quite considerably below their average value. The carriers surveyed clearly identify the lack of demand as the main limiting factor.

On the other hand, the latest INSEE economic survey reveals a very negative change in the balance of opinion on the evolution of cash flow, measured quarterly. We have to go back to April 2020, that is to say in the middle of the Covid period and lockdowns, to find such a deteriorated situation. A pessimism which can be explained by the difficulty that carriers have in passing on the increases in their costs.

2/ Evolution of costs and prices

The improvement in the third quarter had a positive effect on transport prices, particularly on the spot market. But at the end of the quarter, the fall was brutal. A slight rise was then noted as the end-of-year holidays approached, but the balloon deflated again fairly quickly, with prices plunging again on the spot market.

In the contract market, there was a continued increase after the low point in September. The renegotiation of annual contracts has made it possible to push through price increases. But these often do not cover the entire increase in costs.

Source: Upply Freight Index[1] According to the economic survey of the Ministry of Transport, the cost price of long-distance transport (for an articulated unit of up to 44 tonnes) fell by 1.4% in the third quarter, following a 0.8% fall in the second quarter. "This drop is exclusively due to the decrease in the professional diesel index (-5.3%)," the ministry's survey highlights.

Source: Upply Freight Index[1] According to the economic survey of the Ministry of Transport, the cost price of long-distance transport (for an articulated unit of up to 44 tonnes) fell by 1.4% in the third quarter, following a 0.8% fall in the second quarter. "This drop is exclusively due to the decrease in the professional diesel index (-5.3%)," the ministry's survey highlights.

The other components of the index are either almost stable or increasing (up to +0.9% for maintenance). The difficulty in passing on these cost increases to transport prices is reflected in the trajectory of the defaults in road transport companies. According to data from Altares, they increased by 35.4% in the 4th quarter of 2024, after an increase of 39.1% in the 3rd quarter and 37.2% in the first half. For the whole of 2024, the number of defaulting road transport company jumped by almost 30%.

Content source : Altares - (C)Upply At the start of 2025, business climate indicators in road freight transport show a slight improvement compared to the low point reached during the 4th quarter of 2024.

Content source : Altares - (C)Upply At the start of 2025, business climate indicators in road freight transport show a slight improvement compared to the low point reached during the 4th quarter of 2024.

But pessimism remains, with worsening projections in terms of turnover, cash flow, and investments.

References

- ^ Upply Freight Index (www.upply.com)