Behind the Scenes of Freeport-McMoRan’s Latest Options Trends

Whales with a lot of money to spend have taken a noticeably bullish stance on Freeport-McMoRan. Looking at options history for Freeport-McMoRan FCX we detected 8 trades. If we consider the specifics of each trade, it is accurate to state that 37% of the investors opened trades with bullish expectations and 25% with bearish.

From the overall spotted trades, 6 are puts, for a total amount of £1,033,520 and 2, calls, for a total amount of £155,211.

Predicted Price Range

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from £32.0 to £43.0 for Freeport-McMoRan during the past quarter.

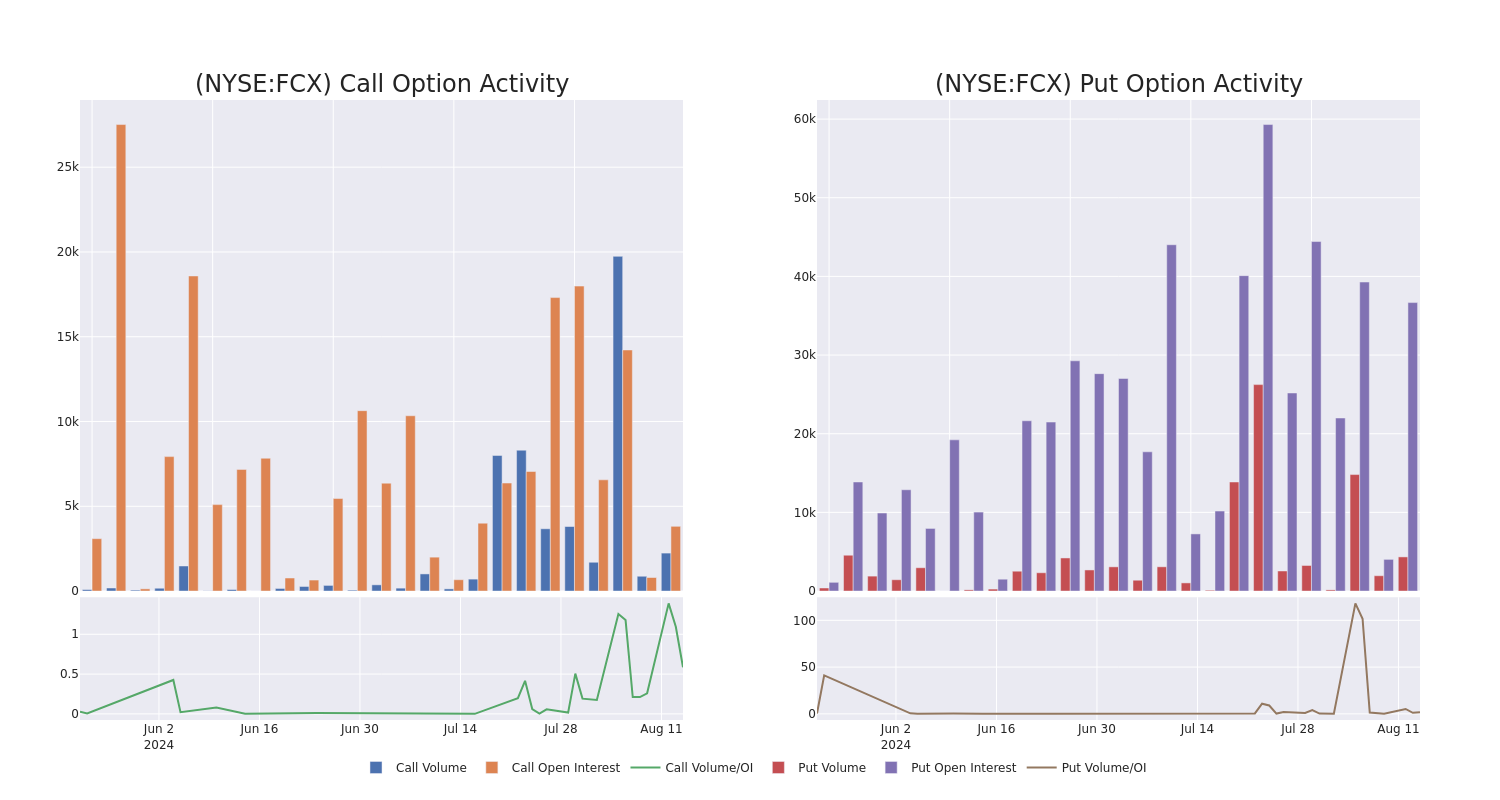

Volume & Open Interest Trends

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Freeport-McMoRan's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Freeport-McMoRan's whale trades within a strike price range from £32.0 to £43.0 in the last 30 days.

Freeport-McMoRan Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

SymbolPUT/CALLTrade TypeSentimentExp.DateAskBidPriceStrike PriceTotal Trade PriceOpen InterestVolumeFCXPUTTRADEBEARISH12/19/25£3.9£3.65£3.82£35.00£573.0K1.3K1.5KFCXPUTTRADENEUTRAL06/20/25£2.11£1.95£2.04£33.00£239.7K7.1K1.1KFCXPUTSWEEPBULLISH01/17/25£4.2£4.15£4.15£42.00£125.7K9.2K402FCXCALLSWEEPBULLISH09/20/24£1.55£1.54£1.55£43.00£122.2K3.8K1.0KFCXPUTTRADENEUTRAL01/17/25£0.85£0.81£0.83£32.00£41.5K17.1K500

About Freeport-McMoRan

Freeport-McMoRan Inc is an international mining company. It has organized its mining operations into four primary divisions: North America copper mines, South America mining, Indonesia mining and Molybdenum mines. Its reportable segments include the Morenci, Cerro Verde and Grasberg (Indonesia mining) copper mines, the Rod & Refining operations and Atlantic Copper Smelting and Refining.

It derives key revenue from the sale of Copper. Having examined the options trading patterns of Freeport-McMoRan, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Where Is Freeport-McMoRan Standing Right Now?

- With a trading volume of 8,632,235, the price of FCX is down by -0.43%, reaching £41.71.

- Current RSI values indicate that the stock is may be approaching oversold.

- Next earnings report is scheduled for 64 days from now.

Expert Opinions on Freeport-McMoRan

3 market experts have recently issued ratings for this stock, with a consensus target price of £57.0.

- An analyst from RBC Capital downgraded its action to Sector Perform with a price target of £60.

- An analyst from Scotiabank has decided to maintain their Sector Outperform rating on Freeport-McMoRan, which currently sits at a price target of £58.

- An analyst from Raymond James has decided to maintain their Outperform rating on Freeport-McMoRan, which currently sits at a price target of £53.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential.

Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely. If you want to stay updated on the latest options trades for Freeport-McMoRan, Benzinga Pro[1] gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs[2](C) 2024 Benzinga.com. Benzinga does not provide investment advice.

All rights reserved.

References

- ^ Benzinga Pro (benzinga.grsm.io)

- ^ Market News and Data brought to you by Benzinga APIs (benzinga.com)