Natural Gas Futures Get Boost from Freeport Restart, Cool Weather-Driven Demand

Natural gas futures resumed their climb on Monday, buoyed by a recovery in Gulf Coast LNG feed gas demand above 12 Bcf/d and Lower 48 gas production staying subdued. A jump in Henry Hub cash prices also added support.

At A Glance:

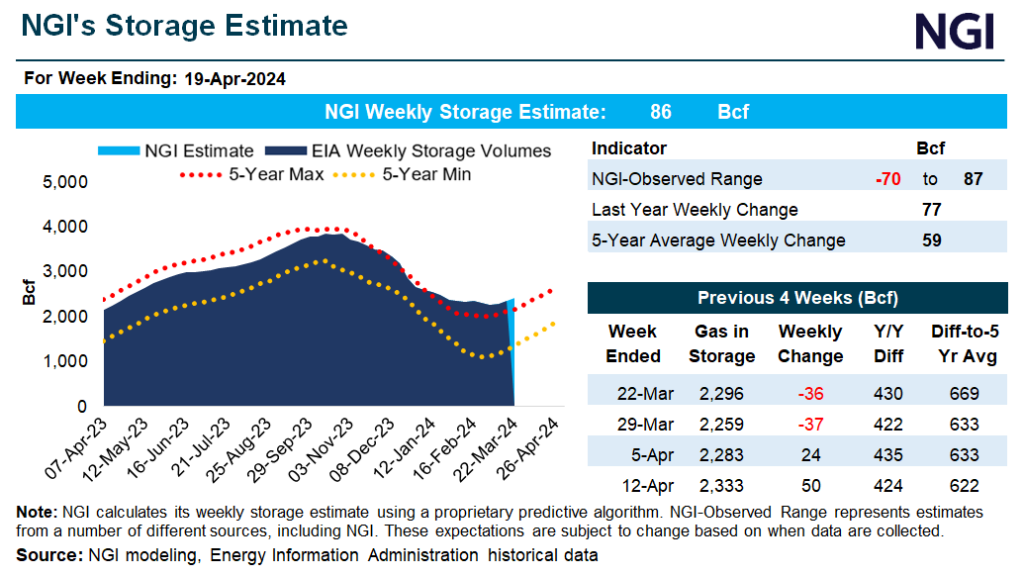

- NGI estimates 86 Bcf injection

- Freeport restarts LNG exports

- Production at 98.2 Bcf/d

Coming off a half-cent drop[1] Friday, the May Nymex contract rose 3.9 cents day/day to settle at £1.791/MMBtu Monday. The June contract jumped 7.7 cents to £2.065.

Cash prices saw gains across all regions, led higher by Texas. NGI's Spot Gas National Avg.[2] added 13.0 cents to £1.340. [Market Moves: What is affecting the natural gas market today?

From the LNG pause to climate goals, get the latest on what is top of mind for the energy industry. Tune in to...[3]

References

- ^ half-cent drop (www.naturalgasintel.com)

- ^ Spot Gas National Avg. (www.naturalgasintel.com)

- ^ [Market Moves: What is affecting the natural gas market today?

From the LNG pause to climate goals, get the latest on what is top of mind for the energy industry.

Tune in to...

(www.naturalgasintel.com)