EV Motors and Drives—Technology in Evolution

New battery technology grabs most of the headlines in the electric vehicle world. But, motors and drives play a critical role in converting electricity into the mechanical force needed to turn wheels or propellers. Unlike internal combustion engines, which rely on burning fuel to generate motion, traction motors deliver torque instantaneously and with high efficiency.

Most e-motors use a permanent magnet (PM) synchronous motor. However, other configurations, such as asynchronous induction motors and electrically excited synchronous machines, are also used, depending on performance, cost and design goals. These motors are tightly integrated with electronic control systems that regulate power flow, motor speed and torque based on real-time vehicle demands.

Increasingly, automakers and suppliers are combining these functions--motor, power electronics and gearbox--into compact e-axle units that simplify assembly and reduce cost and weight. According to a recent study conducted by IDTechEx, 85 percent of electric vehicles currently use PM motors, 12 percent use induction motors and 3 percent use externally excited synchronous motors. Traditional traction motors remain the dominant technology in battery-electric vehicles, because of their high-power density and efficiency across a wide range of applications.

But, alternatives like wound rotor synchronous motors (WRSM) and induction motors are gaining importance as OEMs look for greater flexibility, supply chain resilience and sustainability. "Permanent magnet motors offer some of the best cycle efficiency ratings according to the WLTP [Worldwide Harmonized Light Vehicles Test Procedure] and have powered the bulk of EV fleets from top-tier manufacturers," says James Edmondson, vice president of research at IDTechEx. "Their high power density enables compact packaging and lower overall weight--critical advantages when trying to extend vehicle range without increasing battery size or cost."

Looking for quick answers on assembly and manufacturing topics? Try Ask ASM, our new smart AI search tool. Ask ASM [1]However, this efficiency comes at a price: reliance on rare-earth materials like neodymium and dysprosium, which are primarily sourced from China. This has triggered concerns about supply chain stability and long-term pricing volatility.

"Improving a motor's efficiency could reduce the battery capacity needed within a vehicle, saving money on battery costs," explains Edmondson. While PM motors tend to be more efficient across the WLTP test cycle, WRSMs can outperform them at higher speeds, making them attractive for specific drive cycles and long-haul applications. BMW and Renault are among the OEMs exploring WRSM adoption in next-generation platforms, seeking to cut back on rare-earth dependency without a significant performance tradeoff.

A full EV drive system is assembled with approximately 150 components vs. up to 1,500 individual parts for a traditional ICE power train. Photo courtesy Volkswagen AG

According to Edmondson, induction motors are another magnet-free option that offer advantages in terms of cost and simplicity. "While they lack the high continuous power output of PM motors, they're effective for short bursts of acceleration and serve as auxiliary units in dual-motor EV configurations," he points out. When not in use, induction motors contribute no rolling drag, making them a practical choice for secondary drive systems. Still, material sourcing remains the key concern driving innovation.

As the United States and other nations push domestic EV manufacturing agendas, the need for locally available, sustainable alternatives to rare earths is growing. Companies such as Proterial (using ferrite magnets), Niron Magnetics (developing iron nitride technology) and Passenger (working with strontium ferrite and manganese aluminum carbon alloys) are investing in alternative materials that could reduce the industry's dependence on China-dominated supply chains. Despite these efforts, rare earth-based magnets continue to outperform alternatives in terms of efficiency and power density.

"PM motors still offer the best tradeoff of size, weight and energy consumption for most high-volume applications," claims Edmondson. Automakers and suppliers continue to face a growing engineering dilemma: how to deliver top-tier motor performance while mitigating cost and supply risks tied to rare-earth materials. As regulators pressure OEMs to improve sustainability across vehicle life cycles, the gap between magnet-based and magnet-free motors may narrow.

Ultimately, there is no one-size-fits-all answer for EV traction motor design. Selection depends on factors such as speed profiles and geographic considerations. Nevertheless, several American and German manufacturers are tackling the challenge.

GM's scalable traction motor architecture is the backbone of its Ultium EV platform. Photo courtesy General Motors

A General Approach to Motors

General Motor's motor and drive strategy hinges on a deeply integrated combination of modular design, digital development and in-house manufacturing.

The use of advanced simulation tools, scalable platforms and purpose-built assembly processes enables GM to adapt across its vehicle lineup. That's why it's focusing on developing a modular, scalable drive unit architecture that underpins the company's Ultium EV platform. At the heart of this strategy are traction motors and integrated drive units.

These assemblies--critical to propulsion performance--are designed with flexibility, manufacturability and integration in mind. "We have a modular architecture," says Norman Peralta, GM executive chief engineer for global electric propulsion systems. "We have developed three different motors, and they are used in multiple applications across our whole EV portfolio." This approach allows GM engineers to use the same hardware across different types of vehicle platforms.

For instance, a front-wheel-drive crossover, a rear-wheel-drive performance car and an all-wheel-drive pickup truck might share motor designs or configurations. "The hardware's the same, but the software might be different," explains Peralta. "You can create a lot of different combinations with this modularity." Each drive unit integrates an electric motor, power electronics and gearbox into a compact assembly that is built in-house.

GM produces front and rear units with differing capabilities and dimensions depending on the application. "We design everything together--the gearbox, the electric motor and the inverter," says Kris Keary, chief engineer for car and crossover SUV drive units and power electronics at General Motors. "We look at everything from efficiency, performance, manufacturability, serviceability and mass--and we're doing that as a system." Virtual tools enable GM engineers to build digital twins of the motor and drive units, simulate how they fit and function in a vehicle, and optimize the design for manufacturing before a single part is produced.

"We use tools to simulate torque ripple, vibration and noise," explains Keary. "We use electromagnetic simulation tools to design the motors and multi-body dynamics to simulate the drive units. "We have a vertically integrated strategy," says Keary. "We wind our own motors, and we build our own stators and rotors."

Each GM drive unit integrates an electric motor, power electronics and gearbox into a compact assembly. Photo courtesy General Motors Ultium motors feature a bar-wound stator construction, which enables high slot fill and excellent thermal performance.

The bar winding--also referred to as hairpin winding--is shaped and inserted with high precision. Those components are made at GM's plant in Lockport, NY, which was recently retooled to support EV drive manufacturing. Once the motor and inverter are produced, they are mated in final drive unit assembly, a process GM has worked to standardize.

"We're trying to make things that are scalable and repeatable," notes Keary. "That includes how we assemble them, how we test them and how we validate them. Throughout this process, engineers rely on early and continuous feedback from their virtual tools." "Before we even build a part, we're modeling the structural integrity of our drive units," adds Peralta. "We're looking at bearing life, gear mesh, lubrication and temperature effects.

That allows us to get the architecture right before we even start cutting metal." According to Keary, final assembly operations are designed for both flexibility and automation. "We're really using a modular system of assemblies," he points out. "If we need to swap in a different gear ratio or motor configuration for a different application; we can do that with minimal rework." Thermal management is another area where virtual development and assembly planning intersect.

Because the drive unit integrates motor and power electronics, GM engineers had to find ways to efficiently cool both components within a single housing. "We're doing thermal analysis across the whole system," says Keary. "That includes coolant flow through the motor, the inverter and the gearbox." The inverter itself is a critical piece of the puzzle.

GM develops its own power electronics hardware, integrating it tightly with the motor. "That tight integration of motor and inverter gives us really good control over performance and thermal behavior," claims Peralta. The inverter, built with silicon carbide or silicon depending on the application, is validated alongside the motor and gearbox as a complete system.

GM assembles these inverters internally and then mounts them directly to the drive unit. "We do full end-of-line testing," says Keary. "We run them with load, measuring torque, current and voltage. That gives us complete confidence before it goes into a vehicle."

GM's investment in flexible tooling and automation ensures that each component--from stator winding to final drive unit assembly--can meet volume and quality targets. "We use automated systems for hairpin insertion, welding and quality checks," explains Keary. "We've worked closely with our manufacturing engineering teams to make sure everything is repeatable and scalable." At the vehicle level, the modular nature of Ultium drive units allows engineers to pair components across multiple platforms.

A single platform can support both front-wheel drive and all-wheel drive variants simply by adding or removing drive units. "You can take the same motor and inverter and just change the software," says Peralta. "That gives us tremendous scale." This modular, vertically integrated approach has enabled GM to control its supply chain and manufacturing processes, in addition to accelerating the rate at which new vehicles can be brought to market.

"Because we do everything together--from the motor to the gearbox to the inverter--we're able to validate and manufacture much faster," claims Keary.

These modular in-wheel motors reduce vehicle weight and improve range by 20 percent. Photo courtesy Orbis Electric

Orbis Electric Wheels Around

Orbis Electric is a start-up company in California that has developed in-wheel axial flux motors that use electric and hybrid power train technology to deliver a slimmer and lighter device. It has several customers that are currently testing the technology in passenger and commercial vehicles. HaloDrive is designed around a modular four-part architecture with breakthrough innovations like an injection-molded plastic stator and a tunable gearset.

This system delivers strong levels of performance, efficiency and configurability, while maintaining high torque and power density with greater thermal stability. It's designed to reduce vehicle weight and improve range by 20 percent. "Our vision with HaloDrive is to significantly advance how businesses transition to electrification by removing electric motor barriers such as deployment costs, material and manufacturability risks, and performance limitations," says Chance Claxton, CEO of Orbis Electric. "With HaloDrive, we offer a high-performance axial flux motor that is not only highly efficient and powerful, but also environmentally sustainable."

"Our approach with HaloDrive is about creating a motor that not only meets the immediate electrification needs across a range of industries, but is also compact and efficient enough to position businesses for future energy and sustainability standards," adds Marcus Hays, chief technology officer at Orbis Electric. "We can achieve exceptional performance while also mitigating risks tied to rare-earth materials, ensuring consistent availability and pricing stability. "Axial flux motors offer significantly greater power and torque density per kilo than other types of permanent magnet motors," explains Hays. "Our company has been advocating for motors positioned within the wheel openings." In-wheel motors are visually distinguishable by a pancake-like form factor, which, due to their exceptionally thin profiles, offer numerous mounting locations.

"Despite these performance advantages, the inherently complex electromechanical internal architecture of axial flux motors requires a significant price premium, which until now has limited their broad adoption," says Hays. "[We] can deliver in-wheel motors that weigh no more than conventional wheel assemblies that are motor-less," claims Hays. "With AI now fully integrated into our computer-operated simulation studies, we are able to analyze thousands and thousands of permutations within a comparatively short period of time," Hays points out. "This enables us to ensure that every possible decimal point of improvement in material and operational efficiency can be realized prior to production.

"Cooler motors are not only more energy efficient, but demand less of the surrounding equipment, including storage batteries, inverters, radiators and cooling systems," says Hays. Seemingly small gains--even a 1 percent improvement in efficiency--compound and lead to significant improvements in range, cost and sustainability. Reducing the volumetric content of metals such as copper and rare-earth magnets is crucial for the company's long-term goal.

"We use two-thirds less of these materials than our competitors, while delivering two times the power and torque," notes Hays. "But, there's more to do."

Direct rotor measurement could enable future designs that rely less on aggressive cooling strategies. Illustration courtesy Continental AG

Continental Takes the Temperature

As EV motors and drives evolve, Tier One suppliers are investing in technology to improve performance and reduce costs. For instance, engineers at Continental AG recently developed a rotor temperature sensor (eRTS). The device enables direct temperature measurement on the rotor, giving e-motors more control over key aspects of power train engineering, potentially unlocking material savings and improved performance.

It opens new possibilities for optimizing both magnet configuration and motor cooling. For PM motors, the ability to measure temperature precisely at the rotor enables engineers to significantly narrow the tolerance range they must design for. That tighter band of uncertainty gives them a choice: either improve performance or reduce the amount of dysprosium required in the magnets.

"In one case, OEMs can reduce the dysprosium content thanks to the smaller tolerance range now needed," says Franck Nieceron, electronic group leader for development e-mobility sensors at Continental. "This leads to material savings in both cost and environmental impact." Alternatively, engineers can maintain their current rare-earth usage and stretch the operating temperature range of the motor, thereby enhancing performance under demanding conditions. The potential impact on motor cooling is also notable.

Direct rotor measurement could enable future designs that rely less on aggressive cooling strategies, although it's still too early to quantify savings in that area. "It will potentially allow for reduced cooling requirements, but so far there is no evaluation of savings," explains Nieceron. "For rotor balancing, integrating the eRTS sensor requires drilling a cavity in the rotor for the sensing unit, a process that could impact existing manufacturing workflows. "In case an imbalance is an issue that must be handled, it is possible to place a corresponding weight symmetrically opposite or to adjust the rotor mass accordingly to achieve overall balance," says Nieceron.

While full standardization is not yet feasible, due to the varied nature of electric motor architectures, the core concept of the mote-transducer unit placed on the stator is already defined. "We have successfully tested the concept and the savings," Nieceron points out. "We are ready to develop the system with car manufacturers. The standardization and integration will follow once serial production comes closer."

This rotor sensor enables direct temperature measurement. Illustration courtesy Continental AG

Given the diversity in EV motor designs, including differences in shape, operating speeds and thermal environments, Continental doesn't expect to deliver a one-size-fits-all solution. Instead, Nieceron says the goal is to adapt the eRTS architecture with only minor modifications to suit different customer requirements and inverter protocols. Beyond integration mechanics, the eRTS system also offers strategic implications for sourcing materials.

By reducing the rotor temperature tolerance range from 59?F to 37?F, the sensor enables tighter performance control and allows OEMs to use less dysprosium. "The reduction of dysprosium will permit us to reduce dependency on rare-earth elements and secure the sourcing of magnets," says Nieceron. "Even a few grams of savings per magnet could lead to substantial cost reductions, given current market prices and projected demand from accelerating global electromobility trends. The resulting savings significantly exceed the cost of the sensor."

Looking ahead, Continental also sees opportunities to combine the eRTS with the existing eRPS (Electric Rotor Position Sensor) to streamline EV drive unit design. By fusing temperature sensing and rotor position tracking into a single product, the company hopes to simplify integration, reduce parts count and shorten assembly time. According to Nieceron, the dual-function approach supports both cost optimization and vehicle performance enhancements. "This goes in the direction of improving car performance and reducing cost," he explains. "Combining these two functionalities into one product will help improve costs and reduce the number of components, which in turn simplifies integration."

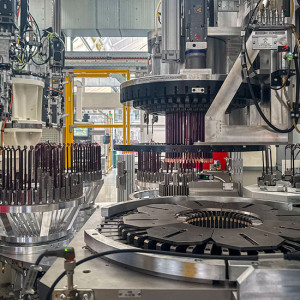

Insulated copper hairpins are inserted into stator slots, shaped and positioned using automated equipment. Photo courtesy Volkswagen AG

Volkswagen Goes Vertical

Volkswagen AG is pursuing a vertically integrated approach to electric drive manufacturing in a bid to optimize performance, cost and supply chain resilience.

Rather than relying entirely on third-party suppliers, the company is producing key components of its electric power trains--including motors, inverters and transmissions--at its global network of factories. "We want to keep the whole system in our own hands," says Lars Hentschel, head of electric drives, systems and components at Volkswagen. Developing electric drive systems in-house allows the automaker to tightly align motor and inverter designs with vehicle-level requirements, such as braking behavior, torque control and power management in relation to battery voltage.

"This is a good way to design a product that is optimized for [our] specific demands," explains Hentschel. "It also avoids the limitations of optimizing individual components in isolation. "If you work only with suppliers, you typically define requirements for one specific component and get a local optimum," adds Alexander Krick, Ph.D., head of technical development for e-drives, inverters and transmissions at Volkswagen Group Components. "What we do instead is optimize all relevant components--battery, inverter and e-motor--together, to reach a global optimum." Volkswagen Group Components serves as an internal Tier One supplier within the company, manufacturing power train systems across several global locations.

Manufacturing locations for electric motors and drives are determined based on market demand and regional requirements. According to Krick, a full EV drive system, including motor, inverter and gearbox, can be assembled from approximately 150 components vs. up to 1,500 individual parts for a traditional internal combustion engine (ICE) power train. "Electric drives are much simpler than ICE power trains, but it is the key component responsible for efficiency," says Krick, adding that a high degree of automation is essential to achieve stringent quality goals.

During rotor assembly, magnets are inserted and fixed to withstand high rotational forces. Photo courtesy Volkswagen AG

Volkswagen uses a highly automated process to mass-produce motors. The most complex element, the stator, begins with a laminated steel core made from 0.2-millimeter thick sheets, which are stamped and prepared with slot insulation to electrically isolate the copper hairpins inserted in the next stages. The insulated copper hairpins are inserted into the stator slots, shaped and positioned into a configuration referred to internally as a "basket." That is joined with the stator core, followed by a series of fully automated steps, including widening, twisting and laser welding, to form all electrical connections.

To stabilize and secure the stator windings for a lifetime of operation, the assembly undergoes a "dipping and trickling" process, where a liquid resin is applied and then hardened through controlled heating and cooling. "This ensures the hairpins are fixed in place," explains Krick. "Otherwise, movement during operation could lead to insulation issues and electrical failures." Rotor assembly follows a parallel path.

Magnets are inserted and fixed with similar hardening techniques to withstand high rotational forces, and then magnetized and dynamically balanced. Once both stator and rotor are complete, they are assembled with the inverter and gearbox into a single drive unit housing, then shipped to VW's final assembly plants. "We first integrate the battery, then the power train and gear shafts," says Hentschel. "The mechanical integration must be exact, but we also ensure all electrical connections and software [systems] are in place.

Everything must be running before a car leaves the factory." "An ICE always needs intake systems, cooling and exhaust treatment--complex systems that only work together in the car," notes Hentschel. "An electric drive just needs voltage, which is easy to simulate." That simplicity makes e-drives more straightforward to validate independently from the full vehicle, helping streamline development and integration.

Volkswagen is also deploying artificial intelligence to support predictive quality on its production lines. "We have dedicated AI systems on the shop floor that can predict whether a component's deviation will lead to acoustic or performance issues down the line," explains Krick. These models are trained using correlations between individual part measurements and end-of-line test results.

They improve continuously with more data. "We look at virtual models, tolerances, gaps and electrical characteristics from the earliest stages," says Hentschel. "If we don't account for key parameters during simulation, we risk problems once the tolerances shift in the factory."

Separately excited synchronous motor technology eliminates rare-earth dependency. Illustration courtesy ZF

ZF Focuses on Sustainability

Tier One supplier ZF is leaning into its expertise in e-motor technology and applying new manufacturing strategies to meet growing demand for EV motors. It's doubling down on localized production, advanced design tools and flexible manufacturing to stay ahead in a competitive and complex market.

"[We have] a long history of e-motor technology development for both hybrid systems and pure EVs," says Sal Ahmad, head of strategy and product line electronics for e-mobility at ZF North America. "More recently, we've made progress in our 'local for local' strategic footprint, with production capability that allows us to eliminate most geopolitical issues. "We have designs that have been adapted to specific markets," Ahmad points out. "[Our] traction motor range spans from 50 to 400 kilowatts, with applications across automotive, commercial vehicles and micromobility segments. Digital innovation is also reshaping [our] product development process.

"Advanced software tools like digital twins and AI are improving validation and testing," notes Ahmad. "The primary benefits are reduced development time and requirement evaluation." Digital twins enable full 3D simulation of manufacturing processes even before assembly lines are physically built, which in turn supports process optimization and reduces time to market. ZF's flex manufacturing strategy was designed to accommodate unpredictable shifts in electrification timelines.

"[It] allows us the flexibility that the current market requires to pivot with evolving market demand," says Ahmad. "Technology and volume flexibility is a key element, due to the uncertainty around electrification timing. "We must be able to offer our customers a full range of propulsion solutions, including ICE, HEV, PHEV and BEV technologies for both the passenger vehicle and commercial vehicle segments," explains Ahmad. According to Ahmad, three pillars support the evolution of EV traction motors and drives: cost, volume flexibility and strategic localization.

Each is essential for scaling production while maintaining competitive pricing in global markets. One of today's biggest challenges is reducing dependence on rare-earth materials. "This supply chain vulnerability threatens the stability and resilience of local manufacturing ecosystems," warns Ahmad. "In the long run, the industry needs to diversify supply sources for rare-earth materials and develop magnet-free technologies."

To address this issue, ZF engineers have developed a separately excited synchronous motor (SESM). It transmits energy for the magnetic field via an inductive exciter inside the rotor shaft. This makes the motor compact, with maximum power and torque density.

Compared to traditional SESM systems, the inductive exciter can reduce losses for the energy transmission into the rotor by 15 percent. In addition, the CO2 footprint in production, which arises with PM synchronous e-motors due to magnets that rely on rare-earth materials, can be reduced by up to 50 percent. Torque density is also significantly increased, because of an innovative rotor design.

The space-neutral integration of the exciter into the rotor means that there are no axial space disadvantages. In addition, an increase in power density in the rotor leads to an improvement in performance. Beyond materials strategy, Ahmad believes that efficiency optimization remains a central objective. "It impacts vehicle range, battery life and overall performance," he points out, adding that sustainability is no longer optional.

"Sustainability practices have become an essential hygiene factor that the market and regulators demand," concludes Ahmad.

References

- ^ Ask ASM -> (www.assemblymag.com)