UK stats claim resurgence in rail freight

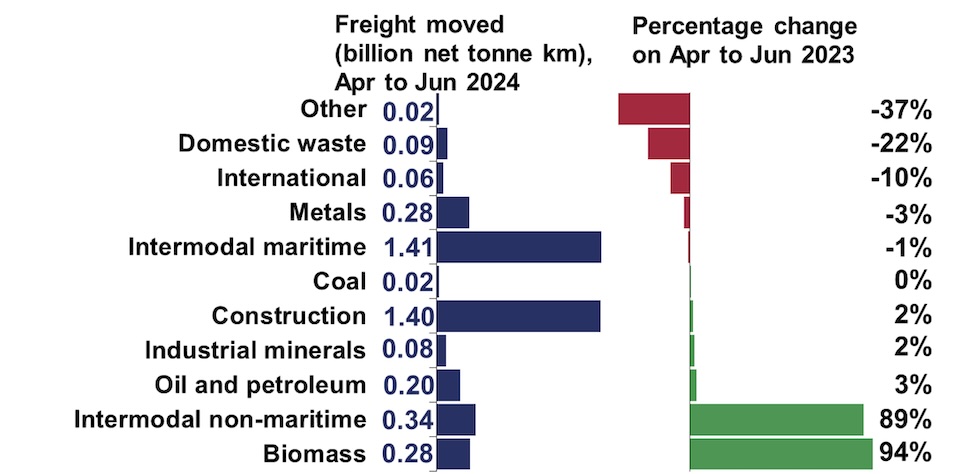

Rail freight moved across Britain's railway has improved by seven per cent. So say the latest quarterly official statistics from the UK government's Office of Rail and Road. Biomass and intermodal non-maritime had the largest percentage increases in freight moved.

According to the quarterly statistics for the period ending in June, the total volume of freight moved was 4.18 billion net tonne-kilometres in the latest quarter. This was a seven per cent year-on-year increase in the same quarter the previous year. Six of the commodity groups measured by the ORR saw a rise in moved volumes compared with the same quarter the previous year.

Domestic intermodal up, metals down

According to the ORR, construction also comprised just over a third of all freight moved in the quarter, representing the second-largest share of all freight moved.

Freight volumes in this sector increased by 2 per cent, reaching 1.40 billion net tonne-kilometres, the highest April to June value since the time series began in April 1998. Intermodal non-maritime saw an increase of 89 per cent. This was the second-largest percentage increase of all the commodities.

It recorded 0.34 billion net tonne-kilometres, which is the highest value of any quarter since the start of the time series in April 2010. There have been progressive increases in the use of rail by retailers such as Tesco and by manufacturers like Coca-Cola.

Freight commodities show some improvements. Graph: (C) ORR.

Freight commodities show some improvements. Graph: (C) ORR.

Biomass volumes increased by 94 per cent, which was the largest percentage increase of all commodities.

It accounted for 0.28 billion net tonne-kilometres, which was the largest value of any quarter from October to December 2021. Increasing use of biomass at Drax is driving substantially higher rail volumes from Immingham and Liverpool. Volumes of metals fell by 3 per cent compared with the previous year in the context of weaker trading conditions affecting UK steelworks.

There continues to be reduced demand for iron ore at Scunthorpe. Metals recorded 0.28 billion net tonne kilometres, making it the lowest April to June value since the start of the time series in April 1998.

Economic advantages of growing the sector

The logistics sector has seen cause for optimism in the figures but cautions the new UK government to act positively. "News from the Office for Rail and Road is a demonstration of the key role that rail can play in driving growth and increased productivity across the economy," said Ellis Shelton, Senior Policy Advisor at business group Logistics UK[1]. "The reliability of the sector, which saw cancellations and lateness at their lowest level for three years for the April-June period, will also ensure that other sectors of the economy can be certain of receiving deliveries on time, vital if delays and rising costs are to be prevented across other parts of the supply chain. We hope that more businesses across the economy will recognise the value that using rail can bring to keep the country moving to generate growth for all."

UK freight punctuality improvements.

UK freight punctuality improvements.

Graph: (C) ORR.

'It is promising to see an increase both in traffic and reliability in the regulator's latest figures on freight rail usage and performance," said Andy Bagnall, the chief executive of the representative body Rail Partners, the authors of the Freight Britain report[2], outlining the economic advantages of growing the sector. Rail Partners freight members have welcomed the figures and Andy Bagnall says they want to build on this by turning the new Government's strong support for rail freight growth into practical actions. "Rail freight operators want to invest in growing and further decarbonising the sector.

They need decision makers to help them create a favourable environment by providing confidence around long term access to the network and investments in capacity. There also needs to be a more level playing field between different modes of freight transport so that freight customers aren't priced out of making the right decision for the environment by rising rail costs compared to road haulage," he said.

You just read one of our premium articles free of charge

Want full access? Take advantage of our exclusive offer

References

- ^ business group Logistics UK (www.railfreight.com)

- ^ the authors of the Freight Britain report (www.railfreight.com)

- ^ See the offer (www.railfreight.com)