New Silk Road: World factors drive rail freight growth

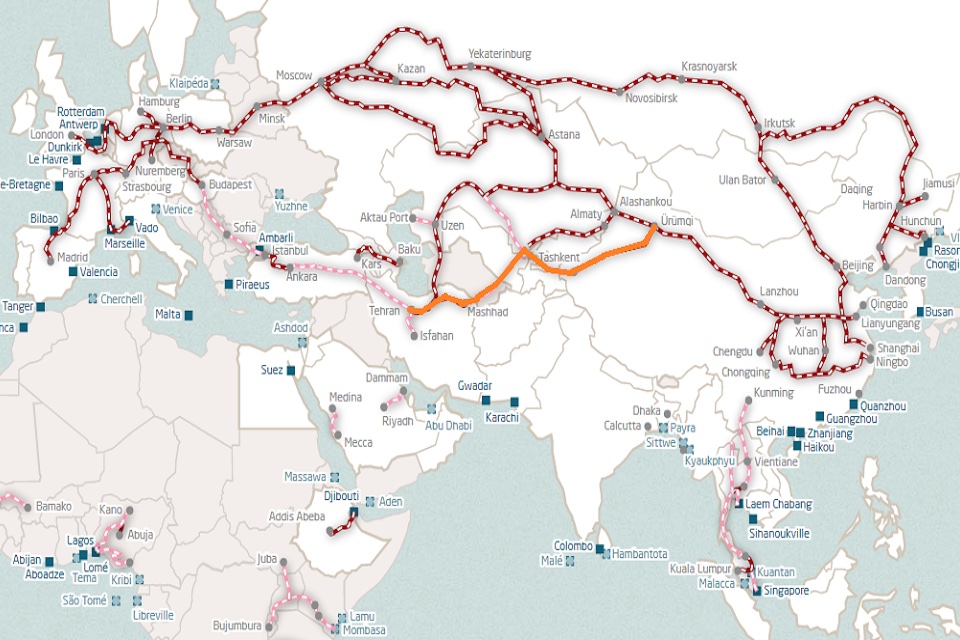

The Chinese government has posted figures that show significant growth in international rail freight traffic. The state-owned railway network has expressed encouragement that trade with Europe, along what's become known as the New Silk Road, is healthier than ever. Global factors are at play, as tensions around the world conspire to make the land bridge between China and Europe more attractive.

War in Ukraine, hostilities in the Middle East, and even the danger of unrest in Bangladesh have all conspired to encourage traders to look again at the New Silk Road. Conducting Eurasian trade by train is prospering.

Forty trains on an average day

The centuries-old overland trade routes between Asia and Europe have never been busier. While the headlines are taken by vast container ships and speedy cargo aircraft, the growth of rail freight traffic has been steady.

For many customers, it has become the preferred logistics chain. Despite a host of issues and challenges, the sector continues to grow.

The many rail routes that make up the modern New Silk Road[1] are the backbone of China's Belt and Road Initiative, the well-established policy of building better trade connections with the Western world. On the border between Northwest China and Kazakhstan, According to Chinese government sources, forty per cent of rail freight trade goes through the modern desert city of Alashankou[2]. Intermodal transfer operations, to overcome gauge differences between the Chinese and Kazakh systems, handle over forty trains on an average day.

The Chinese railway authorities say that 7746 trains used the corridor in the first half of 2024 - making this cold desert outpost a busier rail freight terminal than Felixstowe, Britain's busiest.

World situation to the advantage of rail

Figures from this month, attributed to the Chinese state railway authority, claim that 1.23 million twenty-foot equivalent units (TEU) of intermodal freight was moved in a total of 11,403 international trains in the first seven months of this year. They also say that loading per train improved too. The authorities say these figures represent an increase of 12 per cent more cargo and 11 per cent more trains, respectively.

Verifying the figures may be difficult, but there are underlying factors which are making rail freight more attractive. Globally, areas of conflict have conspired against Eurasian trade logistics. The obvious issue for Western markets is the war in Ukraine.

That has made air cargo problematic since many airlines are reluctant to overfly Russian airspace. British Airways discontinued its London - Beijing route only last week for this reason. Similarly, attacks on shipping in the Red Sea have encouraged cargo vessels to avoid Suez[3] and take the longer route around Africa.

Both these situations have widened the margin within which overland rail freight is the more financially attractive alternative. Even so, there is little room for complacency. The port-to-port nature of air and sea transport is still attractive.

The volatile situations in several territories have not yet impacted rail freight transport, but that is not to say that trains are immune. For now, rail has an advantage and the world situation appears to be playing into the hand of the Silk Road.

You just read one of our articles for free

To continue reading, subscribe to WorldCargo News

By subscribing you will have:

- Access to all regular and exclusive content

- Discount on selected events

- Full access to the entire digital archive

- 10x per year Digital Magazine

SUBSCRIBE or, if you are already a member Log In[4][5] Having problems logging in?

Call +31(0)10 280 1000 or send an email to [email protected].

References

- ^ modern New Silk Road (www.railfreight.com)

- ^ desert city of Alashankou (www.worldcargonews.com)

- ^ cargo vessels to avoid Suez (www.worldcargonews.com)

- ^ SUBSCRIBE (www.worldcargonews.com)

- ^ Log In (www.worldcargonews.com)