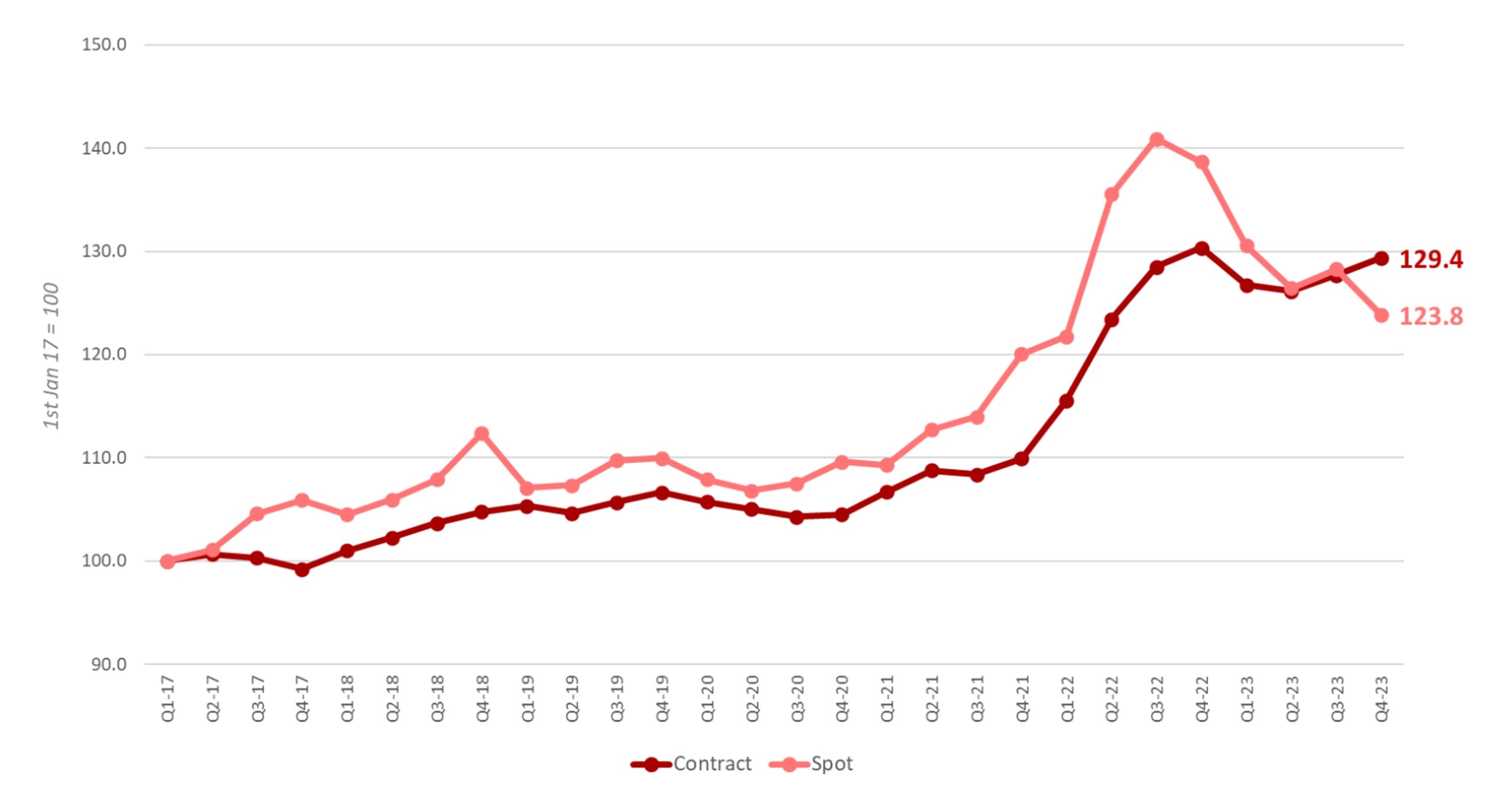

European road freight spot rates dip below contract rates

The European road freight spot rates have dipped below the contract rates that have kept their level due to high costs, in particular, the toll increases in the fourth quarter of 2023. The latest update on road freight rates prepared by IRU, Ti and Upply shows that the European road freight index shows the fourth quarter spot rate index dipped 14.8 points year over year. Weak and falling demand for road freight across Europe has pulled down spot rates, while contract rates remained elevated due to cost pressure.

The spot index now sits 5.5 points below the contract index, meaning that spot rates are now closer to their base level than contract rates. A combination of spot falls driven by declining industrial demand, in addition to contract rises caused by new emission tolls and general cost growth, resulted in contract prices climbing above spot rates from German cities to Paris, Birmingham, Milan, Lille, Madrid, Rotterdam, and Antwerp. Since rates spiked in the first half of 2022, plummeting consumption triggered by soaring prices has been the primary catalyst for consistent spot rate falls.

However, in a new climate of diminished inflation, consumption has now settled at lower levels, resulting in lower road freight volumes.

Source: IRU

Source: IRU

Thomas Larrieu, Upply's Chief Executive Officer, comments, "At the start of 2024, shippers now have access to spot rates that are lower than contractual rates. This year, road transport operators will have to cope with a fall in European demand, which has already been underway for several months, and with the unpredictability of their costs. Now is the time to accelerate the adoption of digital tools, which provide visibility and enable revenue optimisation."

Increasing costs pushing road freight cost base up

Costs have increased across the board over the previous three years.

Labour (+28.2 per cent), maintenance and repair (+20.4 per cent), tyres (+21.6 per cent), spare parts (+13.5 per cent), and insurance (+8.7 per cent) have all increased considerably and contributed to a particularly bloated cost base. This is the result of inflation passing through the system, adding upward pressure to rates and preventing rate falls. Germany's new emission-based tolls came into effect on December 1, 2023, effectively increasing tolls for heavy-goods vehicles on German roads by around 80 per cent.

According to GVN, the Lower Saxony Carrier Association, this increase will result in an additional EUR300,000 monthly expense for some of its members. This is measurable in Germany's domestic road freight rate index, which showed that rates were up by 8.3 points in December. Read also: ESTA: heavy transport reform proposal up for a vote[1]

IRU estimates that the new tolls introduce an additional EUR6,700 annual cost per truck in Germany. Whereas the new tolls in Austria, introduced on January 1, 2024, are set to increase annual costs per truck by EUR730. Vincent Erard, IRU's Senior Director for Strategy and Development, adds, "The European road transport sector is facing falling industrial demand, which is pulling down spot rates.

But contract rates remain high due to cost pressure driven by new CO2 toll taxes and general cost increases." Industrial output contraction and falling new orders look set to take over the deflationary mantle from a now-settled consumer demand. This is likely to produce further rate falls, especially in the spot market.

However, the extension of the new emissions-based toll system to other European countries is set to further inflate an already elevated road freight cost base.

This could put upward pressure on contract rates while limiting price falls and squeezing margins in the spot market.

Sign up to the Project Cargo Journal Newsletter

References

- ^ ESTA: heavy transport reform proposal up for a vote (www.projectcargojournal.com)