We Ran A Stock Scan For Earnings Growth And P.A.M. Transportation Services (NASDAQ:PTSI) Passed With Ease

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like P.A.M. Transportation Services (NASDAQ:PTSI), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out our latest analysis for P.A.M. Transportation Services

How Quickly Is P.A.M.

Transportation Services Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That makes EPS growth an attractive quality for any company. To the delight of shareholders, P.A.M.

Transportation Services has achieved impressive annual EPS growth of 57%, compound, over the last three years. That sort of growth rarely ever lasts long, but it is well worth paying attention to when it happens. Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth.

Not all of P.A.M. Transportation Services' revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. P.A.M.

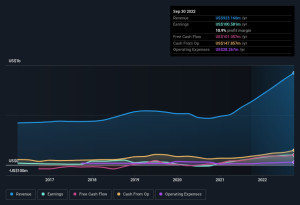

Transportation Services maintained stable EBIT margins over the last year, all while growing revenue 45% to US£923m. That's progress. In the chart below, you can see how the company has grown earnings and revenue, over time.

To see the actual numbers, click on the chart. Story continues

earnings-and-revenue-history

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are P.A.M. Transportation Services Insiders Aligned With All Shareholders?

Seeing insiders owning a large portion of the shares on issue is often a good sign.

Their incentives will be aligned with the investors and there's less of a probability in a sudden sell-off that would impact the share price. So those who are interested in P.A.M. Transportation Services will be delighted to know that insiders have shown their belief, holding a large proportion of the company's shares.

Indeed, with a collective holding of 72%, company insiders are in control and have plenty of capital behind the venture. Intuition will tell you this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. And their holding is extremely valuable at the current share price, totalling US£407m.

That level of investment from insiders is nothing to sneeze at. It means a lot to see insiders invested in the business, but shareholders may be wondering if remuneration policies are in their best interest. Our quick analysis into CEO remuneration would seem to indicate they are.

Our analysis has discovered that the median total compensation for the CEOs of companies like P.A.M. Transportation Services with market caps between US£200m and US£800m is about US£2.7m. P.A.M.

Transportation Services offered total compensation worth US£1.5m to its CEO in the year to December 2021. That comes in below the average for similar sized companies and seems pretty reasonable. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests.

Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Is P.A.M. Transportation Services Worth Keeping An Eye On?

P.A.M. Transportation Services' earnings per share have been soaring, with growth rates sky high.

The sweetener is that insiders have a mountain of stock, and the CEO remuneration is quite reasonable. The sharp increase in earnings could signal good business momentum. P.A.M.

Transportation Services certainly ticks a few boxes, so we think it's probably well worth further consideration. We don't want to rain on the parade too much, but we did also find 1 warning sign for P.A.M.

Transportation Services that you need to be mindful of. Although P.A.M. Transportation Services certainly looks good, it may appeal to more investors if insiders were buying up shares.

If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for. Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction. Have feedback on this article?

Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com. This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You'll receive a US£30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here